Autumn Budget 2024: rethinking succession planning

We consider the impact of the Autumn Budget 2024 on tax, pensions and wider succession issues for individuals and business owners.

Key Points

What is the issue?

The Autumn Budget 2024 introduced major changes to inheritance tax reliefs and the taxation of pensions on death. From April 2026, business property relief and agricultural property relief will be capped at £1 million, with excess value only receiving 50% relief. This may create cashflow challenges for asset-rich, cash-poor businesses needing to meet inheritance tax liabilities.

What does it mean for me?

Individuals should consider making lifetime gifts or transfers to trusts before April 2026 to utilise the current higher rate of relief. Life insurance can also safeguard against inheritance tax liabilities. Those with substantial pension savings may need to reconsider investment strategies, increase drawings and reassess which assets to deplete for retirement expenses.

What can I take away?

Business owners and families must carefully plan how and when to pass on business interests and wealth while protecting assets through mechanisms like prenuptial agreements, trusts and corporate structures. Professional advice is recommended to navigate the complexities and ensure optimal outcomes.

The key point to note is that in light of the changes to reliefs for inheritance tax, individuals should now review their succession planning strategy to ensure that their transfer of wealth to future generations can be as efficient as possible under the new rules.

The headlines covered in this article are as follows:

- Business and agricultural assets exceeding £1 million, previously attracting 100% relief from inheritance tax, will now be exposed to tax at 20% from 6 April 2026.

- Business owners should consider the impact of these potential inheritance tax charges on their cashflow, whilst continuing to meet short-term obligations and increasing employment costs (such as wages and national insurance).

- Lifetime gifts to the next generation and/or trusts could both be considered as viable options to manage any future inheritance tax on death, and life insurance could reduce the impact of inheritance tax charges even further.

- Most undrawn pension funds and death benefits are exposed to inheritance tax from 6 April 2027.

On 30 October 2024, the Chancellor of the Exchequer, Rachel Reeves, unveiled the Autumn Budget 2024, marking the new government’s first major fiscal event. Anticipation was high for significant changes impacting individuals, as the government had made it clear that they were looking to raise taxes.

The changes that were announced included reform to the taxation of non-UK domiciled individuals, changes to pensions, capital gains tax and inheritance tax.

This article delves into the two key changes that may impact the succession planning of individuals within the scope of UK inheritance tax: reform to business property relief and agricultural property relief; and the changes to the taxation of pensions on death.

This article was written immediately following the Autumn Budget on 30 October and therefore all of the draft legislation has not yet been seen. Impacted individuals should take specific tax advice based on their circumstances, in the context of their wider financial affairs, retirement objectives and estate planning requirements.

Inheritance tax reform

Position prior to 30 October 2024

Inheritance tax is charged on an individual’s estate on death and on certain lifetime transfers into trusts. The standard inheritance tax rate on death is 40%, which is charged on the value that exceeds the tax-free nil-rate band, currently set at £325,000. However, there are various reliefs and exemptions available.

Both business property relief and agricultural property relief have broadly been a feature of inheritance tax since it was first introduced, and were designed to prevent the need for businesses and farms to be sold or broken up when passed to the next generation, particularly if the estate had few liquid assets to meet an inheritance tax liability. The reliefs allow these enterprises to continue to operate without the financial strain of considering significant inheritance tax liabilities arising by reference to the property on the death of an owner.

Business property relief and agricultural property relief allow qualifying assets (most commonly shares in unquoted trading companies, including shares in companies listed on the Alternative Investment Market (AIM-listed shares),

and/or qualifying agricultural land and buildings) to benefit from up to 100% relief, provided the asset has been held for at least two years (subject to various conditions and restrictions). Currently, these reliefs are uncapped and can essentially reduce the inheritance tax exposure on qualifying assets to nil.

Position from 6 April 2026

It is intended that, from 6 April 2026, business property relief and agricultural property relief are to be reformed such that:

- The 100% relief for business property relief and agricultural property relief qualifying assets (excluding AIM-listed shares, which are covered below) will be capped at £1 million of combined value that is included in an individual’s estate (including assets held at death, and those gifted in the previous seven years).

- Any excess combined value above this £1 million threshold will only benefit from 50% relief; in short, giving an effective rate of inheritance tax of 20% on any excess chargeable value on death.

- Business property relief on AIM-listed shares is to be reduced to 50% relief (with no £1 million threshold).

Impact on lifetime gifts made ahead of 6 April 2026

Whilst the business property relief and agricultural property relief changes on death are not expected to be implemented until 6 April 2026, it is important to note that the new rules will apply to lifetime transfers from 30 October 2024 where the donor dies after 6 April 2026. Where lifetime gifts are made after 30 October 2024 and the donor dies after 6 April 2026 but within seven years, the gift will be a failed ‘potentially exempt transfer’. It will be subject to inheritance tax with the reduced rate of 50% relief applying. Taper relief will be available where the donor has survived the gift by three years.

Trusts

For completeness, we note that the reform to business property relief and agricultural property relief will impact trustees who currently hold qualifying business or agricultural property in a similar (but not identical) way as set out above. A detailed technical consultation is expected into the application to trusts, and trustees should seek advice on this.

Cashflow considerations

One of the most immediate and pressing concerns for trading and agricultural businesses in light of the changes is cashflow. Cashflow is crucial for businesses to both meet short-term financial obligations and ensure investment in and continuity for the business in the longer term. This could be particularly problematic for asset-rich, cash-poor individuals and businesses, who may not have sufficient liquid assets to cover the tax bill without selling assets.

Inheritance tax is fundamentally a personal tax liability; however, successors and/or executors of business owners are likely to look to the business for help to fund such liabilities. For most businesses, funding could be provided either by way of dividend or share buyback, but the tax consequences of either option would need to be fully considered, as there could be a tax cost associated with accessing the funds.

Where businesses are not able to meet these liabilities out of accumulated earnings, the main options to raise funds include:

- Borrowing funds: Borrowing may be the most viable option to finance the cost of inheritance tax but this approach comes with its own set of challenges. Businesses will need to assess their creditworthiness, negotiate loan terms and ensure that they can service the debt without compromising their operations. Additionally, the added cost of borrowing increases the overall cost, further straining cashflow.

- Selling part of the business: Businesses may opt to sell part of their operations to raise the necessary funds. This strategy can be particularly challenging, as it may involve divesting profitable divisions or assets that are integral to the business’s success. The sale process itself is likely to generate further tax considerations and can be time-consuming. Timing can be crucial to achieve the desired financial outcome, especially if market conditions are unfavourable.

It is important to note that the inheritance tax liability arising on qualifying business and agricultural property may be paid by interest-free instalments in certain circumstances. This allows for the burden to be spread over a period of up to 10 years. Otherwise, instalments would attract the HMRC official rate of interest (increasing to the Bank of England base rate plus 4% from 6 April 2025). This may leave businesses wishing to consider third party borrowing as an alternative.

Practical issues

For those impacted, robust cashflow management will become more important. There could be three issues arising from the change in focus:

- The need to focus on liquidity for inheritance tax purposes may force a business to defer or scale back planned investments to conserve cash.

- An associated point is that holding increasing cash reserves may be treated as an ‘excepted asset’ for business property relief purposes (exposed to inheritance tax at 40%) and therefore may increase any inheritance tax liabilities further.

- Businesses may need to adjust pricing strategies to ensure sufficient cashflow, potentially impacting competitiveness and market positioning.

How will these changes impact me?

The impact of the changes to business property relief and agricultural property relief will always depend on your personal circumstances and succession strategy.

However, there are several options available to manage this impact as part of a long-term strategy (see the box Long-term strategy options for further details).

Long-term strategy options

- Lifetime gifts: Gifting assets directly to the next generation during your lifetime remains inheritance tax-free provided you survive seven years. Other taxes should also be considered, but business asset holdover relief remains in existence to manage the capital gains tax position on the transfer of qualifying business assets. For most individuals, they may find this option for generational transfers the simplest.

- Transfers to trust: Gifting assets into trust may be appealing for those who are considering generational transfers but wish to retain an element of control and/or asset protection. Subject to the draft legislation, transfers of qualifying assets made before 6 April 2026 should still attract business property relief and agricultural property relief under the current rates of up to 100% (provided the donor survives seven years from the date of gift). Once formed, assets held by the trustees will be within the relevant property regime incurring inheritance tax charges at up to 3% every 10 years on the value of the net assets – assuming that the assets in trust continue to qualify for business property relief and agricultural property relief.

- Insurance: Life insurance can safeguard against inheritance tax liabilities on both lifetime gifts (as noted above) and on death. Insurance plans can be designed to offer a fixed sum payment upon the death of the donor, in the event that they die within seven years, and under the current rules sit outside of the estate for inheritance tax purposes. Specific financial advice should be sought in this respect.

Pensions

When it comes to succession planning, it’s essential to consider all assets that contribute to personal wealth, and pension savings are no exception. Pension savings, often accumulated over a lifetime of work, are designed to provide financial security during retirement but, for many individuals, they also play a crucial role in the broader context of wealth management and succession planning.

There were no changes announced in the Autumn Budget in relation to the core pension legislation (in areas such as the tax-free cash lump sum, annual allowance and tax relief on pension contributions), but there was a significant announcement on pensions and inheritance tax.

From 6 April 2027, most undrawn pension funds and death benefits are to be included within the value of a person’s estate for inheritance tax purposes. In practice, this means that remaining pension assets will be exposed to inheritance tax at 40%. The main impact of this will be on defined contribution or money purchase pensions (where the contributions are invested to build up a fund which can be used to provide a pension).

Tax relief on pensions has become one of the most expensive reliefs in the personal tax system. Looking at the tax year 2022/23, the gross income tax and national insurance contribution relief bill on pensions amounted to £70.6 billion. The change announced in the Autumn Budget allows for accelerated tax receipts.

Those individuals with material defined contribution pension savings, who had intended to draw limited, if any, retirement benefits in their lifetimes and leave their pension savings untouched for succession planning purposes free of inheritance tax, may now be left considering their options.

Impact for pension beneficiaries

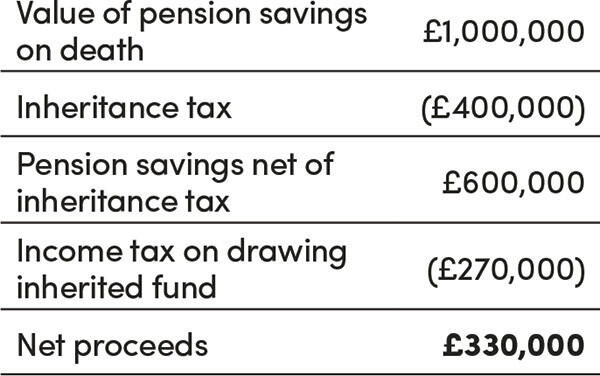

For those who die over the age of 75 (as is statistically most likely), inheritance tax will be due on death, with income tax then due on beneficiaries when they draw down on the remaining inherited pension fund – resulting in combined taxes of up to 67%. For example, an individual with £1 million of pension savings would be impacted in the following way (assuming there is no inheritance tax nil-rate band available for the pension fund and beneficiaries are additional rate income taxpayers):

Further, it is important to note that pension savings will also count towards the taper threshold for the purposes of the residential nil-rate band, which may result in an increased level of inheritance tax on other assets within the individual’s estate.

Government consultation

As part of the Autumn Budget, the government has opened a consultation focusing on the practical operation and the details of implementation, which runs until 22 January 2025. This covers all UK registered pension schemes and Qualifying Non-UK Pension Schemes (QNUPS), noting that a Qualifying Recognised Overseas Pension Scheme (QROPS) is a type of QNUPS. UK defined benefit pensions are generally expected to be outside of the scope of these provisions (since they cease on the death of the member and their dependents).

The features of the proposed regime include:

- overlaying inheritance tax to the current operation of UK registered pension schemes and QNUPS, such that they are subject to UK inheritance tax on the death of a member;

- where an estate includes different elements (property owned directly, property owned in trust, undrawn pension savings), the nil-rate band will be apportioned between those elements;

- inheritance tax on the undrawn pension funds is to be settled from the pension fund;

- for those who die over the age of 75, inheritance tax is to be paid from the pension scheme on death, with income tax then due on beneficiaries when they draw down on the remaining inherited pension fund;

- the spousal exemption is to remain available; and

- payments to charity are to be outside of the new provisions.

Unapproved pension schemes: FURBS and EFRBS

Funded Unapproved Retirement Benefit Schemes (FURBS) and Employer-Financed Retirement Benefit Schemes (EFRBS) are unapproved top up pension schemes that were funded with employer contributions. Generally speaking, FURBS were funded prior to 6 April 2006 and EFRBS thereafter.

Whilst FURBS and EFRBS are not subject to the announcements made in the Autumn Budget, it would be strange for these schemes to have a better inheritance tax profile than registered pension schemes and QNUPS.

This builds on the decision in a 2020 Supreme Court case (HMRC v Parry and others [2020] UKSC 35) where such schemes were found to be vulnerable to inheritance tax. Those with FURBS and EFRBS should seek specific tax advice now. (This was covered in ‘Deferral of retirement benefits’, Tax Adviser, March 2021).

Considering your plans for your pension savings

This change is clearly something that individuals will need to consider carefully as part of their overall wealth strategy and succession planning. There will be options available. Evolving patterns are likely to include:

- reconsidering how these pension funds are invested (such that pension investment returns realign to the needs of the member in light of changes to their pensions strategy);

- increasing drawings from accumulated pension savings in retirement (and what then to do with the proceeds); and

- reassessing the order in which assets are depleted to fund retirement expenses or generational transfers.

Passing on and protecting wealth

Alongside the tax considerations, it remains of paramount importance for families to consider how and when they should pass on their business interests and wealth to their children, as well as the extent to which they can protect the wealth following the transfer, for future generations.

How and when to start the family wealth generational transfer is and will always remain a personal as much as a fiscal question with some key factors for consideration likely to be:

- who you want to benefit;

- what assets they will receive and how these will be split;

- whether you want to restrict access and retain control over the investments; and

- how much wealth you want and need to retain.

Passing on wealth needs to meet the specific needs of the family, as well as the business. Wider conversations will be essential to achieve the family’s holistic as well as business goals.

Inheritance tax reform is likely to incentivise shared ownership structures as a means of facilitating generational transfers. As regards asset protection, there are several legal mechanisms that can be used to achieve this:

- Prenuptial and postnuptial arrangements: Prenuptial and postnuptial agreements can offer a level of protection for family wealth in the event of a divorce. These agreements can specify how assets, including shares in the family business, will be divided on a divorce, ensuring that the family’s wealth remains intact.

- Trusts: As highlighted above, trusts can be an effective way to protect and manage family wealth. By placing assets in a trust, the family can ensure that the wealth is managed according to their wishes with an added layer of protection from potential risks such as divorce, bankruptcy or mismanagement. Whilst trusts can prove complex in certain scenarios, they remain an efficient vehicle to accrue and distribute family wealth.

- Holding wealth in companies and partnerships: Alternative wealth structures such as companies or partnerships can be used to manage, protect and grow family wealth across generations. These structures can offer various benefits, including asset protection, tax efficiency and centralised management, and can focus on the specific needs and goals of the family, as well as the legal and tax considerations in their jurisdiction.

Professional tax, legal and valuations advice is essential and highly recommended to navigate the complexities involved and to ensure any structure reflects the family’s intentions and objectives.

Conclusion

The changes announced in the Budget will have significant implications for many taxpayers. There are options available, but business owners and those with significant pension savings should act soon to review their exposure to inheritance tax and reconsider their wider succession plans.