A complicated gift

Mark McLaughlin looks at the tax ‘life’ of a restricted security in the hands of a company employee from acquisition to disposal

Key Points

What is the issue?

This article focuses on the tax treatment of an employer company’s shares in the hands of an employee, from acquisition to disposal.

What does it mean for me?

The employment-related securities legislation defines ‘restricted securities’ very widely where there is a restriction on a share resulting in the market value of the share being altered. If the market value of the share is not reduced by a restriction, it is not a restricted security.

What can I take away?

There is a general reporting requirement when shares in a company are issued to employees (including past or future employees). However, it is not necessary to report some transactions.

Many employees will be blissfully unaware of the employment-related securities (ERS) provisions, and the potential implications if they own shares in their employer company. Furthermore, some tax practitioners might be forgiven for underestimating the broad scope of the rules.

The ERS legislation occupies a sizeable chunk of legislation (ITEPA 2003 Pt 7). Entire publications have been written about ERS. There are several different categories of ERS, each with their own tax rules, such as convertible securities, and securities acquired for less than market value.

This article focuses on one category of ERS that is encountered relatively often in practice, namely restricted securities. It looks at the tax treatment of an employer company’s shares in the hands of an employee, from acquisition to disposal (all references are to ITEPA 2003 unless otherwise stated).

Setting the scene

The ERS legislation applies to directors, employees and office holders. Subject to certain narrow exemptions (see below), securities and/or options in a past, present or future employer held by an employee are deemed to stem from the employment. ‘Securities’ includes company shares, as well as (among other things) loan stock, but not cheques, bankers’ drafts, etc.

There are certain exceptions from the ERS regime. Perhaps the most common exception is for family or personal relationships; the ‘deeming’ provision is removed where the right or opportunity to benefit from a share is provided to an individual in the ‘normal course of the domestic, family or personal relationships’ of that person (ITEPA 2003 s 421B(3)). In most cases, a ‘gift’ of shares to a family member who works in the family company will be covered by this exception, but the exception can be more difficult to prove where the individual concerned is an unrelated close friend (see HMRC’s Employment Related Securities manual at ERSM20220).

Restricted securities

The ERS legislation defines ‘restricted securities’ very widely (ITEPA 2003 s 423). Those provisions apply where there is a restriction on a share (by reason of any agreement, contract, arrangement or condition) resulting in the market value of the share being altered. If the market value of the share is not reduced by a restriction, it is not a restricted security.

There are three major types of restriction in the ERS legislation:

- Provision for transfer, reversion or forfeiture: This applies where a share runs the risk of being taken away from the employee for less than its market value in specified circumstances (e.g. the employee might have valuable shares in the company that he would be required to sell back to the company at par if he left the employment).

- Restriction on freedom to retain or sell the shares or to exercise certain share rights: This broadly applies to provisions under which the employee cannot freely keep or sell a share; or keep the proceeds of any sale; or there is provision for any other restriction (e.g. the right to vote, etc.).

- Potential disadvantages in respect of the securities: This covers provision for any other restrictions to the potential disadvantage of the employee (or certain others). For example, there may be a provision that the employee can receive dividends and vote but must always waive the dividends and vote as instructed.

It is important to establish whether the shares concerned are subject to restriction or whether the characteristics of the share are simply ‘generic’ to that class of shares in the company. If the characteristics of the share are enshrined in the Articles of the company as applying to all shares of that class, and an employee gets some of those shares, there is probably no ‘restriction’ (ERSM30310).

An income tax charge arises on restricted securities if there is a ‘chargeable event’ (ITEPA 2003 s 426). There are three categories of chargeable event (ITEPA 2003 s 427):

- the lifting of all restrictions from the securities, before they have been disposed of to an unconnected person;

- the variation of any of the restrictions, before they have been disposed of to an unconnected person; and

- the disposal of the securities to an unconnected person, before all the restrictions have been lifted.

The variation of a restriction includes the removal of a restriction; in other words, if there is a security with several restrictions attached, a chargeable event will occur on each occasion that one of the restrictions ends.

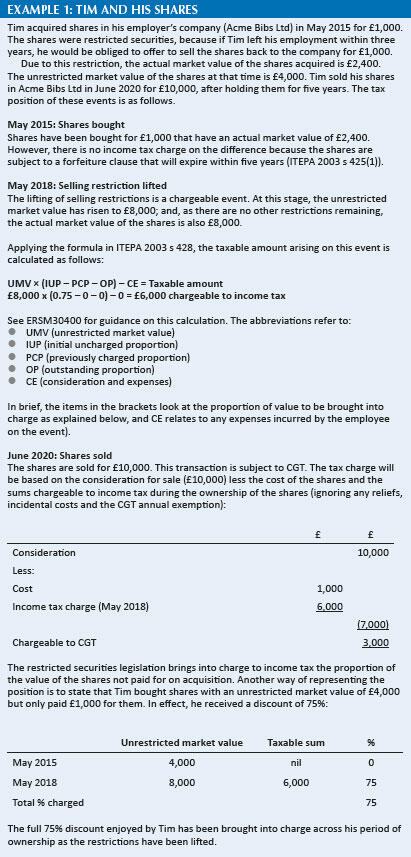

The income tax charge (under ITEPA 2003 s 428) is based on a rather daunting formula. HMRC’s Employment Related Securities manual includes ‘simple’ examples of the calculation (at ERSM30420), and ‘complex’ examples (at ERSM30430).

To understand the legislation and HMRC’s guidance, it might be helpful to understand what the legislation is trying to do. When a restricted share has been acquired by the employee, a charge would have arisen based on money’s worth.

This would have looked at any difference between what was paid for the share and its actual market value at the time of acquisition. The actual market value will reflect any characteristics of the share at that time.

If the impact of restrictions on the market value of that share was ignored, it would be reasonable to expect that the market value would be greater; this is referred to as the unrestricted market value.

The difference between those two values (i.e. unrestricted market value and actual market value) is not ordinarily subject to tax on the acquisition of the share (although see above where an election is made). The employee therefore has a share which could potentially give extra value if those restrictions were released or varied, or if the share were sold to someone to whom the restrictions had no impact. The restricted securities provisions are aimed at taxing this potential additional value when a chargeable event occurs (see Example 1).

Election for market value

In Example 1, an irrevocable election could have been made jointly by Tim and Acme Bibs Ltd to ignore the above restriction and replace it with a tax charge based on the full value of the shares on acquisition (ITEPA 2003 s 431(1)). An election must be made no more than 14 days after the shares are acquired; however, it is not submitted to HMRC but must be retained in case it is required for later inspection.

If there is more than one restriction, an election can be made to ignore certain restrictions, but leaving others to be charged to tax on acquisition (ITEPA 2003 s 431(2)). HMRC will not normally extend the time limit for making the election; but varying a restriction can create an opportunity to make an election to deem all restrictions to have been lifted (under ITEPA 2003 s 430(1)). Examples of both election forms are available via HMRC’s Employment Related Securities manual at ERSM30450.

The above elections give the taxpayer the opportunity to identify and exclude from the above charge any specific restrictions that are anticipated to be lifted, and which would give rise to an increase in the tax bill (assuming the shares rose in value).

In certain circumstances, an election under ITEPA 2003 s 431 is deemed to have been made by employer and employee. Those circumstances are broadly where shares are acquired under a tax advantaged scheme (e.g. enterprise management incentives), or where securities are acquired as part of an avoidance scheme (see ITEPA 2003 ss 431A and 431B).

Telling HMRC

There is a general reporting requirement (in ITEPA 2003 ss 421J and 421K(3)(a)) when shares in a company are issued to employees (including past or future employees). The relevant return (i.e. HMRC’s ‘other’ template) must be made to HMRC by 6 July following the relevant tax year.

However, it is not necessary to report some transactions; for example, where a limited company is incorporated in the UK and initial subscriber shares are acquired directly on incorporation; or on transfer from a company formation agent, etc. where certain conditions are met (see ERSM140040). Nevertheless, all shares acquired in those circumstances by officers of the company or otherwise, by reason of employment, are employment-related securities.

ERS schemes, including one-off awards or gifts of shares, should be registered with HMRC. The Gov.uk website provides links to end of year return templates, technical and guidance notes (tinyurl.com/Template-ERS).