Employee ownership trusts: key benefits and conditions

We consider the benefits, conditions and challenges of employee ownership trusts, as well as the changes introduced in the Autumn Budget 2024.

Key Points

What is the issue?

An employee ownership trust is a type of employee benefit trust that acquires a controlling interest in a company on behalf of its employees. Tax reliefs introduced in 2014 encourage this transition, offering 100% capital gains tax relief on share disposals to employee ownership trusts and allowing tax-free bonuses for employees.

What does it mean for me?

The Autumn Budget 2024 introduced changes to the rules, including restrictions on former owners controlling the employee ownership trust, residency requirements for trustees, ensuring shares are not overvalued, and clarifying tax treatment of contributions to acquisition costs. Directors can now be excluded from tax-free bonus payments without breaching equality requirements.

What can I take away?

Despite the advantages, employee ownership trusts present challenges such as high upfront costs, complex valuation processes and funding difficulties. They are more viable for companies with stable income streams and financial stability.

Given the various capital gains tax rate rises announced in the Autumn Budget and the limited scope of business asset disposal relief, it seems likely that the use of employee ownership trusts will continue to increase. Now therefore seems like a good time to look at the main benefits and conditions regarding the use of employee ownership trusts, some of the key challenges in using them and what the recent Budget changes to the rules mean.

What is an employee ownership trust?

An employee ownership trust is a specific type of employee benefit trust, which is used to acquire a controlling interest in a company which it holds on behalf of all the employees. In some ways, the acquisition by an employee ownership trust of a controlling interest in a company can be seen as akin to an employee buyout. It also provides a solution for a company seeking to transition ownership (typically in the context of succession planning) while maintaining continuity, culture and motivating its workforce.

In order to encourage companies to transition to employee ownership (using an employee ownership trust), favourable tax reliefs were introduced in 2014.

These reliefs allow individuals who dispose of shares in a trading company (or the parent company of a trading group) to the trustee(s) of an employee ownership trust to benefit from 100% capital gains tax relief on the disposal. They also allow employees of the employee ownership trust-owned company to receive an income tax-free bonus of up to £3,600 per year. However, as with all tax reliefs, there are a number of complex conditions that need to be satisfied in order to obtain them.

Transitioning to an employee ownership trust model

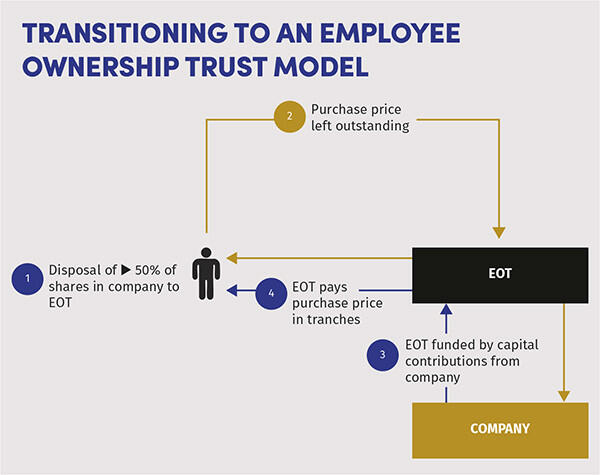

In terms of a company transitioning to an employee ownership trust model, the key steps involved are:

- Establish a qualifying employee ownership trust.

- The shareholders sell their shares to the employee ownership trust trustee(s) under a share purchase agreement. In practice, the trustee is often a private company limited by guarantee with employees of the company on its board. As newly established employee ownership trusts will not typically have any funds of their own to pay upfront for the shares, it is common for all or part of the consideration due to the selling owners to remain outstanding at the point of sale, typically for a period of up to seven years.

- The company continues to generate trading profits each year and uses the profits to make contributions to the employee ownership trust, which it uses to repay the outstanding purchase price plus interest that it owes to the selling shareholders.

See the diagram Transitioning to an employee ownership model.

Autumn Budget 2024 changes

Several changes were announced in the Budget to the employee ownership trust rules; however, following HMRC’s consultation in 2023 regarding the taxation of employee ownership trusts none were entirely unexpected.

Trustee appointments

One of the conditions for the reliefs to be available is that the employee ownership trust must hold more than 50% of the ordinary share capital in the company. As such, following a company owner transferring their company to employee ownership through an employee ownership trust, the trustee(s) will exercise control of the company on behalf of the employees through their controlling shareholding.

However, prior to the Budget, there were no conditions regarding trustee appointments, allowing a former owner to retain control of the company after the transfer through majority control of the employee ownership trust trustee board.

The government was not convinced that such an arrangement would deliver any meaningful change for the employees of the company. As such, the Budget introduced new provisions (with effect from 30 October 2024) that prevent former owners (alone or with connected persons) from controlling the employee ownership trust.

In brief, it requires more than half of the trustees of the employee ownership trust to be persons who are not the former owners or persons connected to them. A breach of these conditions after disposal would be a disqualifying event and lead to an immediate capital gains tax charge to the trustee(s) (or to the former owner, if within the first year following disposal). The restriction does not, however, prevent former owners and connected persons from acting as trustees of the employee ownership trust, provided that they do not constitute a majority of the trustees.

Trustee residency status

The Budget also introduced conditions regarding the residency status of employee ownership trust trustee(s). Previously, there were no conditions regarding residency, meaning that the employee ownership trust could be established as a non-UK tax resident trust (by appointing non-UK resident trustees), resulting in no liability to pay capital gains tax on any subsequent disposal of the company shares, or on a deemed disposal where a disqualifying event occurs.

The conditions introduced by the Budget broadly require that the trustee(s) of an employee ownership trust be UK resident as a single body of persons (as defined in the Taxation of Chargeable Gains Act (TCGA) 1992 s 69. This, in turn, requires that either the trustees of the employee ownership trust all be UK residents or that the trustees be a mix of UK resident and non-UK resident, provided that the former owner was UK resident or domiciled at the date the shares were disposed of to the employee ownership trust.

A breach of this condition at any time after the disposal (that is, a UK-resident employee ownership trust becoming non-UK resident) would result in a capital gains tax ‘exit charge’ under existing provisions in TCGA 1992 s 80.

Market value for shares

Following the Budget, the employee ownership trust trustee(s) are now required to take all reasonable steps to ensure that they do not pay more than the market value for the shares. In practice, this is likely to mean that a valuation will need to be carried out prior to the sale of the company to the employee ownership trust. Also, if interest is charged on the deferred consideration, it must not be higher than a reasonable commercial rate.

Contributions to the acquisition cost

As mentioned above, it is typical for the company (once controlled by the employee ownership trust) to make contributions to the employee ownership trust to allow it to repay the outstanding purchase price. However, there has always been a concern that such contributions could be liable to income tax in the hands of the trustee(s) under the Corporation Tax Act (CTA) 2010 s 1000.

In a welcome move, the Budget (with effect from 30 October 2024) has made it clear that such contributions are not treated as distributions for the purposes of CTA 2010 ss 1000 or 1020, provided they are used to pay the trustee’s acquisition costs.

Annual bonus

One of the conditions that needs to be satisfied for an employee-owned company to be able to pay up to £3,600 annually as an income tax-free bonus to its employees is that the bonus must be paid to all ‘eligible employees’ on the ‘same terms’ – the so-called equality requirement in Income Tax (Earnings and Pensions) Act 2003 s 312B.

In practice, in some circumstances, this requirement could be difficult to satisfy. For example, companies with non-executive directors could struggle to satisfy the requirement, because the requirement requires non-executive directors (as employees) to receive a qualifying bonus notwithstanding that they are not typically entitled to bonuses.

Following the Budget, from 30 October 2024 directors can be excluded from a bonus payment without breaching the equality requirement.

Outstanding issues

While the above changes are all positive news for employees, they do not address (and in some cases actually increase) some of the typical difficulties associated with employee ownership trusts.

While employee ownership trusts offer numerous advantages, there are several challenges and difficulties businesses may face when implementing them. Key amongst them are the relatively high upfront costs, the valuation process and funding the acquisition.

Transferring a company to an employee ownership trust will invariably result in costs being incurred. These would typically be for legal and financial advice and valuation services, but could also include the cost of restructuring the company’s shareholding. The valuation process itself could be complex, especially in relation to privately owned companies that do not have readily available market data, making it more difficult to arrive at an agreeable figure. Any disputes about the valuation will invariably lead to delays and additional costs.

While some third-party lenders may be willing to lend funds to the company or the employee ownership trust to fund the acquisition cost, in practice accessing such finance is likely to be difficult or impossible given the security a third-party lender is likely to require, especially when any existing borrowing and security charges are considered.

Given the funding difficulties, the employee ownership trust model will continue to be more viable for companies that can self-finance the acquisition cost – in other words, companies with stable and predictable income streams and a solid financial foundation.

In spite of their advantages and the Budget changes, it is clear that employee ownership trusts do not provide a ‘one size fits all’ solution for companies and their succession plans but for the ‘right’ companies can be a very attractive solution.