AI for Tax: navigating the future of taxation

The CIOT is delighted to launch AI for Tax to help you start your AI journey.

AI for Tax is a new short course designed to help kick start AI learning. It will provide you with the skills and knowledge to begin to understand how AI can add to the tools you use to deliver tax advice to your clients. The tax landscape is constantly changing and advances in tax technology are increasing efficiencies. Tax advisers can work faster, more accurately and respond better to regulatory and reporting changes.

It’s critical that we keep up with the rapid pace of change. This is why we are delighted to launch our second digitally focused learning programme, AI for Tax, following the success of the CIOT Diploma in Tax Technology.

What can AI do?

AI and Generative AI (GenAI) are revolutionising the tax profession, opening up new possibilities for efficiency, accuracy and strategic decision making. As in many other sectors, AI is radically changing the way that tax professionals will work, from automating time-consuming tasks like data entry, compliance checks and reporting, to enhancing fraud detection and helping to manage audit risks. Gen AI takes this even further, offering powerful tools to analyse vast amounts of data, generate actionable insights and assist in providing responses to complex tax queries.

Understanding AI and GenAI as they are being deployed in tax is essential for professionals who are looking to remain competitive in a rapidly evolving field. As these technologies become integral to tax workflows, those who can critically embrace them will be able to provide more effective client support. Understanding AI capabilities allows professionals to better perceive the opportunities and risks that these technologies present, helping them to stay at the forefront of change in this new era of tax.

How can we help?

That is why we have introduced AI for Tax, an introductory eight hour course on these revolutionising technologies, designed to provide professionals with the foundational knowledge to start exploring the fascinating world of AI and GenAI in tax contexts. If you are a tax professional working in practice or industry, or if you are seeking to move into a tax technology environment, then this course will help you to kick start your learning and provide a relevant introduction to AI and machine learning.

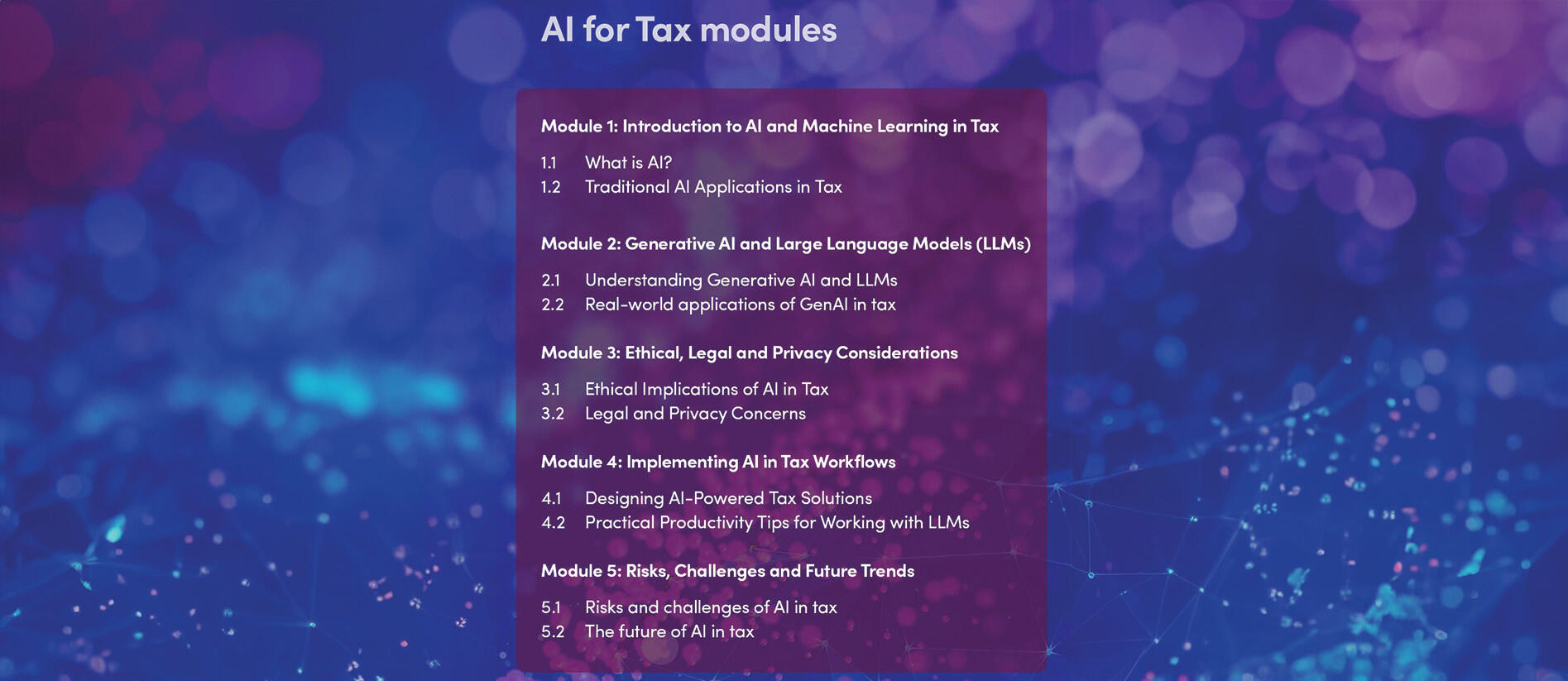

Coefficient has been selected as the course provider to develop and deliver this introductory course, and we consulted with industry experts to ensure that the latest and most relevant learning is available across the five modules, which includes a total of eight hours of learning.

Through this course, participants will gain understanding of AI and GenAI technologies, and the knowledge to make informed decisions when overseeing AI projects and working with technical vendors. CIOT’s AI for Tax is an accessible, online, easily digestible short course which includes quizzes, case studies and podcasts for an engaging learning experience. The course includes modern AI (GenAI and large language models), as well as more traditional AI. It also covers data science, deep learning and machine learning. It offers a light introduction to general AI concepts, the history of AI and machine learning, and neural networks, with interactive and real-world examples, case studies and exercises relevant to the tax domain.

The course is designed to develop learning and can count towards your continuing professional development obligations for the year. There is no examination beyond the self-assessment exercises within the programme and it provides the ideal introduction to tax technology from which you can move into our Diploma in Tax Technology.

As an Institute, we pride ourselves on being at the forefront of tax education where evolving technologies will support our members. We strive to update and develop the Diploma in Tax Technology and our new AI for Tax course, to keep pace with the ever-changing tax technology environment. Find out more at:

www.tax.org.uk/ai-for-tax

Vicky Putrill

Director of Education, CIOT