Deceased estates: the administration period

We consider how a deceased estate is taxed during the administration period, which runs from the date of death until all assets and liabilities have been identified and quantified.

Key Points

What is the issue?

There are three main types of legacies: specific legacies (gifts of specific assets), general legacies (gifts of money or property not distinguished from others of the same kind) and residuary legacies (gifts of all or a share of what is left after other legacies and expenses are paid).

What does it mean for me?

An estate is administered by the ‘personal representatives’, who should not pay any legacies from the estate until they are confident that there are sufficient assets to pay the deceased’s debts, any inheritance tax due on death, and expenses.

What can I take away?

Specific legatees are entitled to income from the assets they receive, while general legatees are not usually entitled to income unless the legacy is delayed. Residuary legatees are taxed on the income generated by their portion of the residue.

This article explains how a deceased estate is taxed during the administration period. This runs from death until the residue is ascertained: the point at which all the estate’s assets and liabilities have been identified and quantified.

To do this, we travel to Oz, in an attempt to tidy up the mess Dorothy has left behind.

Case study: The Wicked Witch of the East

The Wicked Witch of the East dies, and her will leaves her estate as follows:

- her broomstick to the Wicked Witch of the North (yes, there is one);

- her silver shoes to the Munchkin Boq;

- her holiday apartment in the Emerald City to the Wicked Witch of the West; and

- 100,000 Oz dollars ($, for ease) to the Munchkin Nimmie Amee.

The rest of her estate is divided two thirds to the Wicked Witch of the South, and one third to the Munchkin Jinjur.

Her assets at death are as follows:

- her silver shoes (they are still hers even if Dorothy steals them, and the personal representatives are obliged to recover them);

- the land her cottage was on, valued at $10,000 (as it is now blighted by cottage and farmhouse debris);

- a holiday apartment in the Emerald City, which is rented out; and

- an investment portfolio with the Bank of Oz worth $500,000.

Her broomstick was destroyed by Dorothy’s farmhouse landing on her cottage.

Personal representatives

An estate is administered by the ‘personal representatives’, which is a term covering both executors and administrators.

The estate will be administered by the executor(s) if the deceased left a valid will which appoints an executor (or executors), who are able and willing to act in that role. Otherwise, the estate will be administered by an administrator, chosen in accordance with rule 22 of the Non‑Contentious Probate Rules 1987.

A will can be valid without naming any executors – there is no requirement to do so, although it makes obvious sense.

Types of legatee

A legatee is anyone who is left something in the will; or if there isn’t a valid will, who receives something under the intestacy rules.

Personal representatives should not pay any legacies from the estate until they are confident that there are sufficient assets to pay the deceased’s debts, any inheritance tax due on death, and expenses. This will include any personal tax liabilities of the deceased arising pre death.

There are broadly three types of legacy, as explained below.

1. Specific legacy

This is a legacy of a specific asset (or assets). The broomstick going to the Witch of the North, the silver shoes going to Boq, and the holiday apartment going to the Witch of the West are all specific legacies.

If the deceased did not own the asset at death, the legatee gets nothing; therefore, the Witch of the North loses out, as the broomstick was destroyed. However, if the will had been phrased slightly differently – stating ‘a broomstick to my friend the Witch of the North’ – then she would get a broomstick regardless of what was owned at death. As the broomstick has been destroyed, the personal representatives would have to buy another one (assuming funds permit), as this would be a general legacy.

2. General legacy

A general legacy is a gift of property or money which is not distinguished from others of the same kind. The $100,000 going to Nimmie Amee is a general legacy. This will be paid as long as there are sufficient funds in the estate.

By contrast, ‘$100,000 from my account with the Munchkin Bank’ would be a specific legacy. As the Witch of the East didn’t have an account with the Munchkin Bank at death, Nimmie Amee would get nothing, even if there is plenty of money in the estate as a whole.

Any legacy of money is a pecuniary legacy.

3. Residuary legacy

This is a legacy of either all or a share of what is left in the estate when the tax, expenses and specific and general legacies have been paid. The Witch of the South and Jinjur are the residuary legatees.

If the will does not say what happens to the residue (again, a will can be valid without disposing of the entire estate), or if, for example, it leaves one third to Jinjur but doesn’t say what happens to the remaining two thirds, any unallocated residue will pass under the intestacy rules.

Income tax for the personal representatives

The personal representatives pay income tax at basic rate, being 8.75% for dividends and 20% for other types of income.

The only expense which can be deducted from income is interest:

- on a loan taken out to pay inheritance tax (not, for example, interest charged on an account which has been overdrawn to pay inheritance tax);

- for the first 12 months of the loan; and

- relating to the inheritance tax on the delivery of the inheritance tax return (and not any additional inheritance tax).

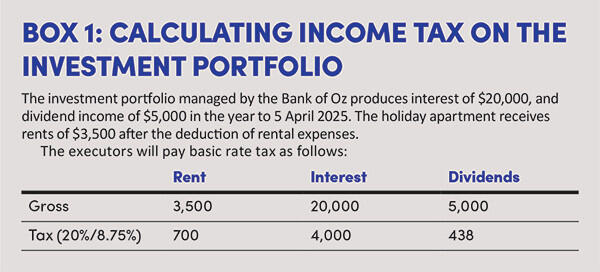

Rental expenses can be deducted as normal from rent received. See Box 1: Calculating income tax on the investment portfolio.

Income received post death must be split between the period prior to death and the period post death, unless the Apportionment Act 1870 has been excluded (which it typically will be in a professionally drafted will). For dividend income, this will involve looking at the companies’ year ends and calculating what proportion of the dividends received relate to pre and post death.

The exemptions from paying tax and filing returns on small amounts of income which apply to trusts also apply to estates:

- Up to 5 April 2024, if the only income the estate received was bank interest totalling less than £500 in any one tax year, there is no need to report the estate to HMRC and no tax to pay.

- From 6 April 2024, this is expanded to include any type of income, providing the total income is less than £500 in any one tax year.

ISAs continue to be exempt from income tax; and capital gains tax is exempt for up to three years after death, or the estate is closed, whichever is sooner.

Income tax for the legatees

1. Specific legatees

Specific legatees will be entitled to any income generated by the asset (or assets) they have been bequeathed. As the Witch of the West is receiving the holiday apartment, she will be entitled to any rental income generated from death.

The personal representatives will pay basic rate tax on the rent, subject to the normal deduction of rental expenses.

The Witch of the West will be taxable on this income when it is paid over to her and will be able to claim credit for the basic rate tax paid by the personal representatives. The legatee cannot be taxed on income they did not receive.

2. General legatees

General legatees will not normally be entitled to any income, so there will be no tax for them to pay. However, if it takes the personal representatives more than a year from death (known as the executor’s year) to pay out a general legacy, the legatee is entitled to statutory interest on the amount they are due, calculated using the basic rate on funds in court.

The personal representatives pay this gross to the legatee (unless the legatee is non-resident, when the personal representatives must deduct basic rate tax). The legatee must pay tax on this interest in the year it is paid to them. If they do not receive the interest, they are not taxable on it.

If the personal representatives appropriate assets towards the payment of a pecuniary legacy, any income from the assets is treated the same way as for a specific legacy.

3. Residuary legatees

Residuary legatees are taxable on the income generated by their portion of the residue of the estate. They are deemed to receive net income whenever they receive a distribution from the residuary estate to the value of the assets received, regardless of what they are. The income distributed will be equal to the lower of the value of the assets distributed and the value of their share of the net undistributed income.

In a similar manner to interest in possession trusts, allowable administration expenses reduce the income taxable on residuary legatees, to the extent that they are properly chargeable to income, ignoring any specific direction in the will. Unrelieved expenses can be carried forward. Income is paid out in such proportions as are reasonable for the legatees’ interests, and then in the following order:

- non-savings income;

- savings income; and

- dividend income.

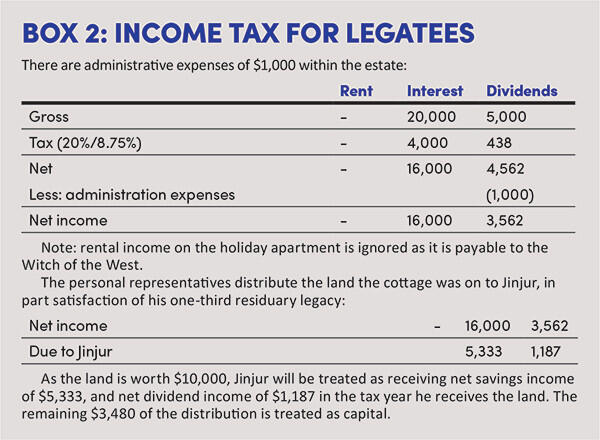

See Box 2: Income tax for legatees

At the end of the administration period, any part of a legatees’ income entitlement which has not been paid to them is treated as their income.

Personal representatives would be wise to consult with legatees before making payments to them, in order to help minimise any personal tax liabilities.

Capital gains tax

Death is not a disposal for capital gains tax purposes, and all assets are rebased to their market value at date of death.

Personal representatives pay capital gains tax at 20% on all gains except for:

- carried interest, which is taxed at 28%; and

- residences not eligible for principal residence relief, which are taxed at 24% from 6 April 2024.

Personal representatives get the same capital gains tax annual exemption as an individual for the year of death and the following two years. If the administration period continues after that, they get no further annual exemptions.

Personal representatives cannot claim business asset disposal relief or investors’ relief.

Main residence relief will apply if the property is left to someone who lives in it as their main residence.

Personal representatives can claim fall in value relief for inheritance tax purposes on quoted investments that are sold at a loss within 12 months of death, and land sold at a loss within four years of death. If they do, their capital gains tax book cost will correspondingly change, and there will likely be a small loss for capital gains tax purposes, being the costs of sale.

The transfer of an asset to a legatee does not trigger a chargeable disposal, and they will inherit the personal representatives’ book cost (i.e. probate value).

Deeds of variation and disclaimers

Deeds of variation and disclaimers alter the way the deceased’s assets devolve on their death. If done within two years of death, elections can be made for capital gains tax and/or inheritance tax purposes to treat the new devolution as having been made in the will or on intestacy.

They have no effect for income tax purposes.

Any trust created by a deed of variation or disclaimer will be treated as settled by the deceased for inheritance tax purposes, but by the original legatee for income tax and capital gains tax purposes.

Practical matters

Ascertaining the residue

It can be difficult to determine precisely when the residue has been ascertained. HMRC will normally accept any reasonable date, although will strenuously resist attempts by wily personal representatives to artificially bring this forward or delay it.

Simple vs complex estates

Estates are classified by HMRC as either simple or complex. An estate is complex if there is chargeable income or gains to report and:

- total income tax and capital gains tax due for the administration period is over £10,000;

- the value of the estate was over £2.5 million at death; or

- the value of the estate’s assets sold by the personal representatives in any one tax year was over £500,000.

Otherwise, the estate will be simple.

Simple estates can use the ‘informal’ procedure, whereby the personal representatives write a letter to HMRC setting out the income and gains received.

Complex estates must file tax returns reporting any income or gains. Usually, this will be an SA900 tax return, the same return used for trusts; however, if there is only a gain on the disposal of UK property to report, a timely capital gains tax on UK property return may meet the filing requirements.

Trust Registration Service

Deceased estates are outside the Fourth and Fifth Money Laundering Directives, and there is no legal requirement for them to register on the Trust Registration Service.

However, HMRC now uses the Trust Registration Service to issue unique taxpayer references (UTRs) for trusts and estates. Therefore, if the informal procedure cannot be used, the estate will need to be registered on the Trust Registration Service to obtain a UTR.

This is undertaken purely for administrative purposes and the personal representatives do not need to keep the Trust Registration Service up to date as for trusts, although HMRC prefers them to do so.

As well as registering the estate itself on the Trust Registration Service to get a UTR if needed, the will and intestacy rules may create a trust, which may also need registering.

Under the Fourth Money Laundering Directive Sch 3A(7), trusts created on death are exempt from registering on the Trust Registration Service, providing they are wound up within two years.

So far, so relatively straightforward. However, bare trusts must register on the Trust Registration Service, unless they fall under one or more of the exemptions, and depending on the precise wording of the will a bare trust may be created. This will need registering if the administration period lasts more than two years.

The rules are too complex to go into in full detail here – this would require another article of similar length, and even more fictional witches, but examples can be found in HMRC’s Trust Registration Service Manual at TRSM23020.

If a trust is created, this will only need registering once it has been constituted; i.e. once assets have been transferred to the trustees. If the will states that the personal representatives hold the estate on trust as part of the administration process, a trust will have been created on death and will therefore need to be registered after two years.

In other cases, the trust will only come into existence once assets have been transferred to the trustees. However, if the trustees and personal representatives are the same people, then the trust will again need registering two years after death.