The Border Target Operating Model: animal and plant products

We examine the regulatory checks and Common User Charge on imports of animals, products of animal origin, plants and plant products.

Key Points

What is the issue?

UK traders need to be familiar with the Border Target Operating Model. New risk categories apply to a range of products of animal origin, plants and plant products (including food).

What does it mean for me?

Traders need to be able to identify relevant goods, including the commodity code classification and country of origin. New certification and inspection requirements are mandatory to allow certain goods to be imported.

What can I take away?

Additional charges (such as the Common User Charge) have made importing controlled goods more costly.

For Great Britain’s businesses, the UK’s withdrawal from the EU single market and customs union at 11pm on 31 December 2020 resulted in fundamental changes to the way goods are traded. Intra-EU dispatches and acquisitions were replaced with import and export formalities and a divergence in regulatory requirements.

Brexit divergence

In addition to all the standard requirements of trading goods internationally (including complying with classification, country of origin and customs valuation rules, etc.), major changes have been made to duty rates in the UK tariff, the format of the customs declaration with the launch of the HMRC Customs Declaration Service, and the way import VAT is accounted for with the introduction of postponed VAT accounting.

One area in which the UK has been slow to adapt is managing biological security. This is a key pillar of border management, so it is no surprise that the EU chose to immediately apply third country regulatory checks on GB animals, products of animal origin, plants and plant products. Collectively, these items are known as sanitary or phytosanitary (SPS) goods, as they can be subject to sanitary or phytosanitary controls and are some of the most complicated and admin intensive items to import.

In contrast with the EU, the UK government has repeatedly delayed the introduction of similar UK checks on EU SPS goods, instead only performing checks on the highest risk live animals and high-risk plants. A variety of reasons have been cited for the delays, including the impact of the global pandemic, industry concerns, lack of inspection facilities and the risk of additional administrative costs further pushing up prices in a time of relatively high inflation.

Over three years since the end of the Brexit transitional period, changes to the UK’s border policy are finally being implemented with the introduction of the UK Border Target Operating Model, the last phase of which is scheduled for 31 October 2024. The changes impact all GB importers; however, businesses in the food and drink, agricultural and manufacturing sectors need to particularly monitor the changes and ensure they abide by the new requirements.

A food wholesaler importing chilled meat, a furniture manufacturer importing timber or a garden centre importing seeds are all examples of traders importing goods subject to UK SPS controls. SMEs that are reliant on low value imports of SPS goods from Europe are particularly exposed and have already found the feasibility of their supply chains called into question.

The Border Target Operating Model: what are the changes?

The Border Target Operating Model is the key policy guiding the UK’s border management. First released in draft form and subject to public consultation, the final version was published in August 2023. The model sets out the UK policy on:

- imports of animals, products of animal origin, plants and plant products (i.e. SPS goods subject to sanitary or phytosanitary controls); and

- safety and security declarations (applying to all imports of goods – of any kind).

These new requirements come with a cost. The government originally estimated a cost to UK businesses of £330 million. However, a recent third-party report suggested £2 billion as a more realistic figure. The changes have been introduced in three phases, each of which require careful consideration.

Phase 1: Risk status (31 January 2024)

On 31 January 2024, new ‘risk categories’ were introduced to govern the import requirements for SPS goods. To find the risk category, the importer needs to know the commodity code of the goods and their country of non-preferential origin. These details can then be checked against lists that have been published by DEFRA online.

Changes were also made to documentation and reporting requirement based on these new risk categories:

- Animals and products of animal origin: All goods appearing in the medium or high-risk category require an export health certificate. An Import of Products, Animals, Food and Feed System notification is required at the border to allow clearance.

- Plants and plant products: All medium and high-risk plants and plant products require a phytosanitary certificate and a notification to the Import of Products, Animals, Food and Feed System.

The export health certificate and phytosanitary certificate are official documents that confirm a consignment meets the UK’s health and biosecurity standards. The export health certificate is completed by a certifying officer in the country of export (e.g. an official veterinarian). The phytosanitary certificate is issued by the competent plant health authority in the country of export.

Goods are physically inspected and certificates will only be issued if all checks are passed. It is the exporter’s responsibility to obtain these certificates.

UK exporters of SPS goods to the EU or rest of the world will already be acutely aware of these documentation requirements. Many EU exporters of SPS goods to the UK have been required to provide certification for the first time as a result of the changes but typically the cost is passed directly on to customers.

The Import of Products, Animals, Food and Feed System is the UK system used to pre-notify a movement of SPS goods. It is run by the Animal and Plant Health Agency and the Department for Environment, Food and Rural Affairs (DEFRA).

A successful notification on the Import of Products, Animals, Food and Feed System generates a document known as a Common Health Entry Document, which contains information about the import for control purposes and is a requirement for the goods to clear the border.

Phase 2: Changes to the entry process and the Common User Charge (30 April 2024)

Checks on SPS goods can take several forms:

Documentary checks: This involves the Port Health authority reviewing the Common Health Entry Document, certification and full suite of commercial documents. This includes the invoice, packing list and bill of lading (the documentation showing shipment details for customs control procedure).

Identity checks: This involves verification that the goods declared on the paperwork can be identified, such as a visual inspection of identification marks, stamps, etc.

Physical checks: Customs law requires that a certain proportion of imports are subject to a physical check for pathogens, disease and contamination. Countries where there is a known issue (e.g. a diseases outbreak) may be targeted. Inspection can involve sampling and taking temperatures.

Changes to the entry process

On 30 April 2024, further changes were made at the border regarding the entry process for SPS goods.

All SPS goods: Goods must enter the UK via a border control post or control point (for plants or plant products).

EU SPS goods: Documentary and ‘risk-based’ identity and physical checks are now required for medium risk animal products, plants, plant products and high-risk food and feed of non‑animal origin. (This does not apply in West Coast GB ports, such as Holyhead, due to additional complexities associated with moving SPS goods from Ireland.)

Common entry health documents must be generated for all live animal, high-risk food and feed of non-animal origin and animal product imports from the EU.

Non-EU SPS goods: Checks and certification requirements for ‘low risk’ SPS goods from non-EU countries have been reduced or removed, with limited exceptions based on intelligence.

Medium risk SPS goods from non-EU countries are less likely to be selected for physical checks.

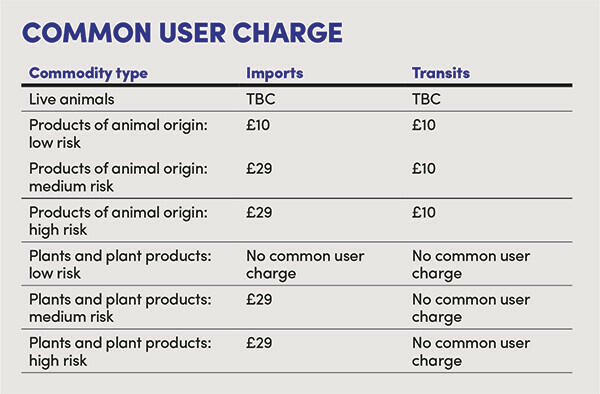

The Common User Charge

In an attempt to recover some of the operating costs associated with running its border control facilities, the government introduced the Common User Charge on 30 April 2024.

The charge applies to a consignment when all of the following apply:

- The import or movement is commercial.

- The goods, such as products of animal origin and plants and plant products, are potentially subject to SPS checks at a government-run border control post in England.

- The goods are being moved via the port of Dover or the Eurotunnel.

- The goods are being imported into Great Britain or are entering or leaving Great Britain under transit suspension.

Dover and Eurotunnel have been targeted as they are the main arrival locations for road freight from the EU. The charge applies for every import or transit movement, regardless of whether the goods are selected for further inspection.

The maximum charge is limited to five commodity lines on the Common Health Entry Document. Any additional lines do not result in additional cost.

If the Common Health Entry Document has commodity lines with different risk categories, the rate of the highest risk category will apply to all commodity lines. When low risk and medium risk commodity lines are combined in the same Common Health Entry Document, the medium risk common user charge rate applies to all lines. For example, an import of five low risk and two medium risk animal products attracts a charge of:

5 x £29 = £145.

The charge does not apply at other commercial ports; however the port operator will need to provide their own border control post facilities and can increase their port fees to cover these costs. The charge does not cover inspection fees, which are administered by Animal and Plant Health Agency, Port Health Authorities and local authorities.

When the conditions are met, liability to pay the charge rests on the importer. In certain circumstances, a UK-based customs agent acting under delegated authority may pay on behalf of the importer. In these circumstances, it is expected that the charge would be disbursed as an additional cost.

DEFRA will issue their own invoices and no VAT will be added to the charge. The first invoice is expected no earlier than 12 weeks after implementation (the week commencing 23 July 2024), with later invoices to be issued monthly in arrears.

Phase 3: Safety and security (31 October 2024)

The last phase of changes will see the introduction of a safety and security declaration requirement for imports from the following countries and territories which currently benefit from a waiver: EU 27, Andorra, Ceuta and Melilla, Heligoland, Liechtenstein, Monaco, Norway, San Marino, Switzerland, the municipalities of Livigno Campione d’Italia, the Italian national waters of Kale Lugano, and the Vatican City State.

Safety and security declarations were introduced as part of the World Customs Organisation SAFE framework, to which the UK is a signatory, and are given force of law in the UK’s customs regulations.

In the UK, information for safety and security at import is submitted on a document known as an Entry Summary Declaration. (The export equivalent is known as the Export Summary Declaration). The legal obligation to submit this declaration lies on the operator of the active means of transport (i.e. the carrier) but can be passed on to other businesses involved in the movement.

Safety and security declarations collect basic information about a consignment, pre-arrival or pre-departure. Border control authorities can then risk assess whether to accept the entry of a good into the country or prioritise goods for inspection where they have appropriate intelligence. For containerised maritime cargo, vessels can be prevented from loading in the port of export if Border Force have reason to reject the movement.

The requirement to provide the safety and security declaration will coincide with the introduction of a reduced data set for the Entry Summary Declaration. Mandatory fields will be reduced to 20, along with eight conditional fields only used in specific circumstances and nine optional fields.

West coast ports

British west coast ports are also expected to begin physical checks on imports into the UK that do not already qualify as being in Northern Irish free circulation. However, a final deadline is yet to be set.

Single Trader Window

The October changes are expected to coincide with further functionality for the UK Single Trader Window. The Single Trader Window is a major HMRC IT project using cloud-based technology. It aims to provide a single login and service to allow traders to interact with the range of authorisations, documents and applications required to import or export their goods.

Rather than traders needing to sign up for a range of different applications or sites, the Single Trader Window will interact directly with HMRC, DEFRA, the Home Office and other interested government agencies.

It is the government’s intention that safety and security declarations will be submitted directly through the Single Trader Window. In addition, there are plans for:

- customs import and export declaration submissions;

- access to import and export data and records;

- excise declarations;

- customs special procedure authorisations; and

- access to SPS Documentation.

Priorities for UK businesses

In order to comply with the Border Target Operating Model changes, it is vital that businesses have identified the risk status and control requirements of goods before they are imported.

When importing relevant SPS goods, appropriate documentation and any notifications to Import of Products, Animals, Food and Feed System should be made well ahead of time. This can be facilitated by planning entry location and working with carriers and agents to ensure information is available to all interested parties.