HMRC Guidance: providing information to individuals, businesses and agents

HMRC provides huge quantities of guidance to individuals, businesses and agents, and is working on ways to make it easier for users to access information.

At HMRC we are constantly reviewing and developing our guidance to ensure we are meeting the needs of our customers. As you can imagine, this is a huge task. HMRC has around 100,000 pages of guidance on

GOV.UK and we make over 4,000 changes a year to keep them up to date and improve them.

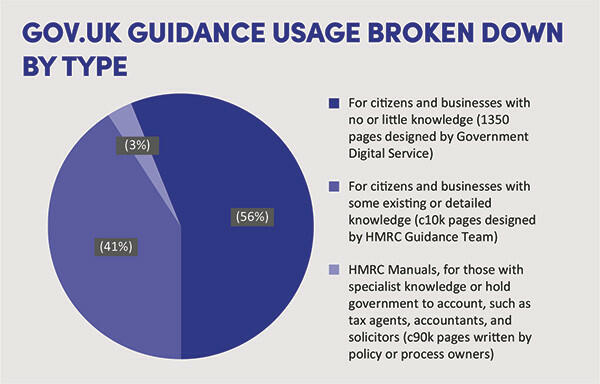

We use the HMRC Individuals, Small Businesses and Agents customer survey as our primary measure of satisfaction (see tinyurl.com/ycum2pm4) with our guidance. In 2022/23, this told us that 61% of agents, 69% of small businesses and 72% of individuals rated our GOV.UK pages positively. Historically, HMRC guidance on GOV.UK has been split broadly into three categories:

- Mainstream content: This is around 1,350 pages and makes up around 56% of annual page views. It is designed for users with little tax knowledge. These pages are mainly designed by Government Digital Services and signed off by HMRC.

- Specialist content: This covers around 10,000 pages designed by HMRC for people and businesses that have or need more detailed tax knowledge. This content gets around 41% of the page views.

- Manuals: These have around 90,000 pages and are written by HMRC specialists. Historically, these were written primarily for HMRC colleagues but in recent years we have paid increasing consideration to the needs of users such as tax agents and solicitors. Our manuals get more than 40 million page views a year.

Follow the data

More than 750 million page views from 100,000 pages, all tagged with a question asking whether the page is helpful, produces a lot of data. In 2019, we started building data feeds and dashboards to highlight and prioritise the guidance that would have the most impact when improved.

Improving our guidance makes it easier for taxpayers to do the right thing, which improves compliance and reduces the demand on HMRC’s services. However, measuring that impact is not always easy. Interrogating our data, alongside insight from bodies such as the Administrative Burdens Advisory Board (ABAB) (see tinyurl.com/c3xamvmp), various representative bodies and our own Guidance Strategy Forum (see tinyurl.com/bdhb6hun), has enabled us to develop and evaluate new approaches, as set out below.

Interactive guidance: We are developing step by step interactive guidance journeys designed to make complex things feel simpler as they step the user through the bits that just apply to them; for example, the starter checklist for PAYE (see tinyurl.com/484vc9sw) and check your UK residence status (see tinyurl.com/ywue3jr7). This approach overcomes the problem of users giving up when faced with large amounts of text, much of which doesn’t apply to them. User satisfaction for interactive guidance is usually over 80%.

Digital Assistant: We are investing more in our Digital Assistant so that it better understands the many different ways that people use to ask similar questions. This has helped it more effectively provide users with relevant guidance and support. Where the Digital Assistant doesn’t find an answer, or the taxpayer needs more support, if HMRC advisers are available it will offer a webchat, which is a service that gets good feedback.

Video content: We are making more use of video content. We produce our own videos, which are posted on our own YouTube channel, but we have been working closely with Government Digital Services to see what happens when we embed them directly in GOV.UK pages. We have tried this on a few different subjects, ranging from child benefit to anti-money laundering, and are currently evaluating the impact.

Feedback: We recognise the importance of our technical manuals and have focused on generating and listening to feedback. In 2022/23, we received more than 500 items of feedback, with 53% resulting in changes. We made 76% of those changes within 15 working days of receiving the feedback and 89% within 40 working days. We encourage users to send us feedback and are grateful to the CIOT for publishing a piece on their website detailing how the process works (see tinyurl.com/2ejmjt98).

Meeting the challenges

Despite the significant increase in the use of the HMRC app and our online services to over 198 million accesses during 2022/23, we still received 38 million calls the same year. If we were to do nothing, the amount of calls would likely increase as result of tax policy changes that bring more taxpayers into the tax system and increase the number of taxpayers with more complex affairs. Alongside HMRC’s target to reduce telephony and post contact by 30% by 2025, this makes it clear that the status quo will not move us quickly enough in the right direction.

The data coming from our recent guidance improvement work, alongside the sheer logic of the benefits of improving guidance, gave us the confidence to make some changes. To increase capacity and further build capability, we brought together our internal and external guidance teams and the HMRC team responsible for building the department’s plain English expertise.

Those changes enabled us to build more interactive guidance journeys (we’ve now delivered almost 50) and to devote more resource to improving, rather than simply maintaining, our existing content.

We’ve also started to make increasing use of our technology. For example, callers to HMRC tell our automated voice system why they are calling us. When we know we have strong guidance or online services that could help with that issue we automatically send the customer an SMS with a link to the guidance or service, if they are using a compatible device. We are also using QR codes on some of our letters to take customers directly to our guidance and online services. We’re currently evaluating the impacts but the early data suggests that these will form an important piece of the jigsaw going forward.

What next?

The first job is, of course, to make sure that we keep GOV.UK up to date in our constantly changing world. We work hard at this, making over 4,000 updates a year, and believe we’re doing well. If you think there’s more that we can do, let us know at [email protected].

Sometimes the up-to-date position can be less clear cut, particularly in technical areas where the legislation leaves room for interpretation or HMRC is being challenged through a tribunal. In these circumstances, we’re working with the Guidance Strategy Forum to consider ways of updating our manuals to make it clearer that an issue is under review.

On guidance improvement, our biggest focus is the announcement made in the 2023 Spring Budget that by April 2025 we will systematically transform the guidance for small businesses. This is really exciting work for us. We’ve built our capacity to enable us to deliver this and have been working closely with our users and their representatives to produce a list of areas that we need to concentrate on. This includes helping users to find all the guidance they need to set up and be compliant from the start, to get their returns right, and to register for Self Assessment and VAT.

At the time of writing, we have worked with users to prioritise these areas and are carrying out user research on prototype solutions.

We’ve been also working closely with Government Digital Service colleagues to increase our capacity to make changes to ‘mainstream content’ more quickly, and, in particular, to reduce the dependency on GDS to implement those changes, while preserving all that is already good about that particular content type. This will be especially helpful for the changes arising from the small business guidance review but will support us to do much more beyond that, too.

Other areas

Beyond our work to transform small business guidance, we have many other things going on to both improve specific guidance and how we deliver it. For example, we’re looking at:

- A range of specific topics within PAYE, Self Assessment, National Insurance, VAT and others too. This isn’t the full, systematic review that we’re carrying out on small business guidance – it’s more about identifying and fixing specific problem areas.

- How we can improve our guidance for more technical users, such as by making better use of examples and by agreeing an alternative format to PDFs that will the give the ‘coherent document’ feel without the accessibility and other drawbacks.

- Working more closely with compliance colleagues to use the data we have about where customers make mistakes that lead to a compliance intervention as a prompt to review the associated guidance to ensure it is giving users what they need.

- Further developing our range of metrics to make sure that we’re giving users what they need. For example, are we reducing the ratio of users who go from our guidance to the ‘contact us’ pages?

We are exploring ways we can do more to put guidance at the point of need. For example, we are working with British Business Bank to include links to GOV.UK guidance on their website to support small business in key areas such as registration, filing and payment processes. If you have ideas or can help us develop ways to put guidance at the point where a user might need it, please do get in touch with us.

Finally, like the rest of the world, we are also looking at ways that artificial intelligence can help us and our customers. This is an exciting and emotive area, and you can be assured that alongside considering the potential of AI to produce content and support designers, we are very mindful of the reliance that our customers place on our guidance and the consequences of any inaccuracies. Uses of AI will comply with our data protection, security and ethical standards.

Our ask of you

Improving HMRC’s guidance is more than just a job to us and we genuinely love to hear feedback and ideas, whether that’s a big concept or a specific piece of guidance. So if you find yourself muttering under your breath, use the GOV.UK feedback routes or email us at [email protected] so that we can take a look.