HMRC’s Interest Review Unit: claims for interest mitigation

As a Freedom of Information request reveals recent activity in HMRC’s Interest Review Unit, we consider how to address claims for interest mitigation.

Key Points

What is the issue?

HMRC’s Interest Review Unit considers objections to interest charges when tax is found owing due to HMRC’s error or unreasonable delay. The unit examines whether the delay was extensive and unreasonable, causing the interest charge to increase.

What does it mean for me?

Data from a Freedom of Information request shows an increasing trend in the number of cases referred to the Interest Review Unit and the proportion of cases where interest was mitigated due to HMRC’s unreasonable delays.

What can I take away?

We encourage advisers to review HMRC’s guidance, make claims for interest mitigation when justified and provide timelines to illustrate unreasonable delays. HMRC’s complaints process should be a last resort.

Speak to most tax advisers or accountants who interact with HMRC on a regular basis and they will be able to provide numerous examples of HMRC standards falling below what could be considered as acceptable. I understand those frustrations at first hand, but I do not believe I am alone in feeling a little uncomfortable about giving HMRC such a hard time when it is not allowed a right to reply.

Like every other adviser, I could provide many examples of letters from HMRC that simply make no sense – research and development enquiries feature strongly here – as well as long periods passing without a word from HMRC. In one case from the last year, I submitted a complaint to HMRC citing the delays on its part as grounds for complaint. After several chasing emails, calls and letters, we eventually received a response from the complaints team, albeit seven months after the original complaint was submitted. The irony was not lost on the officer who dealt with the complaint, very fairly in my opinion.

However, the purpose of this article is to provide some thoughts on how best to navigate HMRC service and make some suggestions for more significant changes to help improve interactions in the long term.

How to measure HMRC performance

When the National Audit Office released its press release in May 2024, it concluded that:

‘HMRC’s telephone customer service is not delivering – average wait time of nearly 23 minutes in first 11 months of 2023/24 (up from 5 minutes in 2018/19). New digital services have not reduced service pressures as much as HMRC expected. HMRC is not expecting to meet its telephone performance target in 2024/25 and has not made clear what level of service customers should expect.’

There are, of course, other ways to measure HMRC performance; for example, measuring the ‘tax gap’, HMRC’s compliance yield or the number of successful criminal prosecutions that HMRC pursues. However, the time spent on hold appears to be the simplest way to measure ‘customer experience’ and I can understand that view.

Readers who do not have the National Audit Office report to hand might be interested to note that ‘customers’ cumulatively spent 798 years on hold in 2022/23, more than double the time spent waiting in 2019/20. Clearly, we would all like to see waiting times come down. I wonder though whether measuring the time on hold to speak with an HMRC adviser is the right way to measure customer experience? I would rather wait longer for a more reliable and accurate response to my query than speak to a less informed HMRC agent in rapid time.

Surely a better measure of HMRC’s performance, and the least contentious from HMRC’s perspective, is to ask how it judges its own performance.

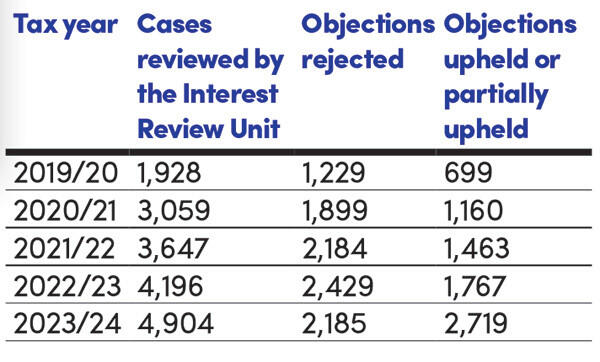

A recent response from HMRC to a Freedom of Information request we made sheds light on this. With reference to the period 2019/20 to 2023/24, we asked HMRC to confirm the number of cases that had been referred to HMRC’s Interest Review Unit and the outcome of decisions reached by that team. The data received in response to our request is contained in the table below. First, though, we look at the role of the Interest Review Unit and why their decisions are relevant to customer experience.

The role of the Interest Review Unit

The Interest Review Unit at HMRC considers objections to paying interest charged when cases are settled, and tax is found owing, in a wide range of cases. The unit is tasked with being fair and impartial. The key principle is that giving up interest is based on the fact that HMRC error or unreasonable delay has financially disadvantaged the customer by:

- creating an interest charge that would not otherwise have had to be paid; or

- increasing the amount of interest charged that already existed or was building up.

Claims that HMRC error or unreasonable delay has caused or added to the build up of interest will be carefully examined. Where the facts prove the claim, HMRC will consider giving up part or all of the interest charged. The Interest Review Unit will only consider interest objections in cases where representations have first been made to the relevant HMRC case team.

The most common requests made to the Interest Review Unit are for reason of unreasonable delay on the part of HMRC. The scenarios where HMRC recognises that this may be the case include those where each of the following apply:

- Interest was increasing during the period involved.

- HMRC was responsible for the conduct of the case during the period.

- The delay was extensive and unreasonable in the circumstances.

- It was only this delay that caused the absence of payment.

- The customer was not aware that a debt existed, or might arise, that they should have paid or made a payment on account against.

It is the third bullet point above that is arguably the most pertinent to the question of HMRC’s service standards. This would indicate that wherever the Interest Review Unit decides to mitigate interest, it has accepted that the delays caused by their colleagues were unreasonable in the circumstances. It speaks to the question of customer service, and objectively what the taxpayer population can reasonably expect from HMRC.

Further guidance of how the Interest Review Unit operates is provided in HMRC’s manuals at Debt Management and Banking Manual DMBM405000 onwards.

What did the Freedom of Information request show?

In response to the Freedom of Information request, the table below summarises the number of cases referred to the Interest Review Unit and the decisions reached.

Two obvious trends appear to have developed over the last five years which arguably speak to a worrying decline in service standards.

The number of cases referred

The first trend is simply the number of cases referred to the Interest Review Unit, which has more than doubled over the last five years. It is interesting that the pandemic years, which fall within the relevant time period, appear to have had little impact on the trend, as referrals have continued to increase.

If more cases are being referred to the Interest Review Unit for consideration, it could mean that more cases justify a referral, indicating declining standards. It could also be argued that it simply shows that the request for cases to be reviewed has increased in popularity.

The outcome of the decisions reached

Readers will note from the above table that in 2019/20 the number of objections to the interest charged where the objection was upheld or partially upheld was 36% of the total cases referred in that year. This has increased every year. 2023/24 was the first year when more than half (55%) of cases referred to the Interest Review Unit resulted in some or all of the interest charged being mitigated.

This tells us that HMRC itself is recognising that standards are slipping. The data shows a trend that HMRC will want to reverse.

Easy wins for HMRC

There are ways that HMRC could reverse the trend of poor customer service and reduce the number of cases reviewed by the Interest Review Unit. In enquiry cases, for example, why not ensure that HMRC compliance officers provide periodic updates to taxpayers and their agents on progress? Some cases will inevitably take longer to investigate but it would address concerns if, for example, HMRC provided a brief update summarising progress on a monthly basis.

Another win, but perhaps less easy to implement, is to bring back the Certificate of Tax Deposit scheme or devise an alternative scheme that works in a similar way. This would encourage taxpayers to make earlier payments towards debts later found to be due and would by its very nature mitigate the late payment interest charged.

Claiming interest mitigation

Advisers whose clients have reasonable grounds to claim interest mitigation should be encouraged to review HMRC’s guidance on this area and make a claim. As with HMRC’s formal complaints procedure, there is an obvious overlap with the service standards published in HMRC’s Charter. Advisers should be familiar with the Charter and point out to caseworkers whenever standards slip.

Good practice when making a request for interest mitigation is to produce a timeline of key milestones. If the caseworker declines to mitigate interest, this should be provided to the Interest Review Unit at the request of the adviser. In our experience, such timelines can help to illustrate any unreasonableness in HMRC’s service.

Despite the overlap of requests for interest mitigation and the complaints process, it is my view that complaints should be seen as the option of last resort. Advisers lose nothing by making the Interest Review Unit consider their client’s case.