National heritage property: savings for the nation

With a number of reliefs available to the owners of heritage property – both land and chattels – we consider how taxpayers could benefit from the options available.

Key Points

What is the issue?

Heritage property reliefs are often overshadowed by agricultural and business property reliefs. However, with upcoming changes limiting these reliefs to 50% for values over £1 million, heritage property reliefs may become more significant.

What does it mean for me?

National heritage property is defined under the Inheritance Tax Act 1984 and includes items of national, scientific, historic or artistic interest, as well as land and buildings of outstanding interest. HMRC, with advisory bodies, determines if an item meets these criteria.

What can I take away?

Various reliefs are available for heritage property owners, including conditional exemption, acceptance in lieu, Heritage Maintenance Funds and the Cultural Gifts Scheme.

Heritage property reliefs can sometimes be regarded as the poor relation of agricultural property relief and business property relief. The standard advice was to claim business property relief, with the conditional exemption as a fallback if that failed.

However, with the upcoming changes to agricultural property relief and business property relief restricting relief to 50% for values over £1 million, now may be the time for heritage property reliefs to rise.

There are a number of reliefs available to the owners of heritage property:

1. Conditional exemption: The conditional exemption provides a deferral of inheritance tax (and may have been used to defer estate duty or capital transfer tax in the past).

2. An acceptance in lieu: This is used to pay inheritance tax and offers a credit (the ‘douceur’) with respect to capital taxes (inheritance tax, estate duty, capital transfer tax and capital gains tax) that would otherwise be due on the disposal.

3. Heritage Maintenance Fund: This enables the owners of heritage property to shelter non-heritage funds from inheritance tax on the basis that they are being used to maintain the heritage property.

4. Cultural Gifts Scheme: This scheme provides income tax and capital gains tax relief on the gift of property to the nation.

Each relief is described in more detail below, but first we must establish what heritage property is.

National heritage property

National heritage property is defined under Inheritance Tax Act 1984 s 31(1) as being:

a) a chattel which is pre-eminent for its national, scientific, historic or artistic interest;

(aa) collections within (a) which as a whole appear to be pre-eminent;

b) land of outstanding scenic, historic or scientific interest;

c) a building which should be preserved due to its outstanding historic or architectural interest;

d) land essential for the character/

amenity of a building in (c); and

e) any object historically associated with a building in (c).

HMRC, in consultation with relevant advisory bodies, such as Arts Council England and Natural England, will determine whether something meets the pre-eminent or outstanding tests. When considering chattels under (a) or (aa), HMRC will take into account any significant connection with a particular place.

Conditional exemption

Conditional exemption is available on chargeable transfers during lifetime and on death. Note that a potentially exempt transfer is not a chargeable transfer unless the donor dies within seven years. Conditional exemption must be claimed. If the claim is successful, no inheritance tax is payable.

The conditions are:

- If the item is a chattel, it remains in the UK, unless HMRC approves it leaving the UK temporarily; e.g. for an exhibition abroad.

- The owner must take all reasonable steps to preserve the item.

- The item must be made accessible to the public, and this must be publicised.

It is possible for a conditionally exempted item to be transferred to a new owner, and for that transfer again to be conditionally exempt, providing the new owner takes on the conditions.

Access

From 31 July 1998, public access cannot be by appointment only, so the item must be viewable at advertised times by anyone who visits. The owner can charge a ‘reasonable’ fee for access. There are also provisions in Finance Act 1998 to enable pre-1998 undertakings to be varied to include public access without prior appointment.

The precise access conditions are agreed with HMRC, but typically will be at least one month a year, as well as offering viewings by appointment. The conditions will vary depending on the nature of the item, with particularly fragile items being permitted reduced opening times. See Conditional exemption: access conditions.

Conditional exemption: access conditions: On the death of his Aunt Mabel, James inherited a plot of land that was valued at £10,000.

Mabel’s personal representatives apply to HMRC for conditional exemption. HMRC consults with Natural England, and it is agreed that the land is of outstanding scientific interest due to the rare species living there. Accordingly, conditional exemption is granted on the understanding that James will maintain the land in its current state. James must open the land to the public for one month each year, together with permitting visits by private appointment.

No inheritance tax is therefore payable on the land’s value of £10,000 on Mabel’s death.

Breach

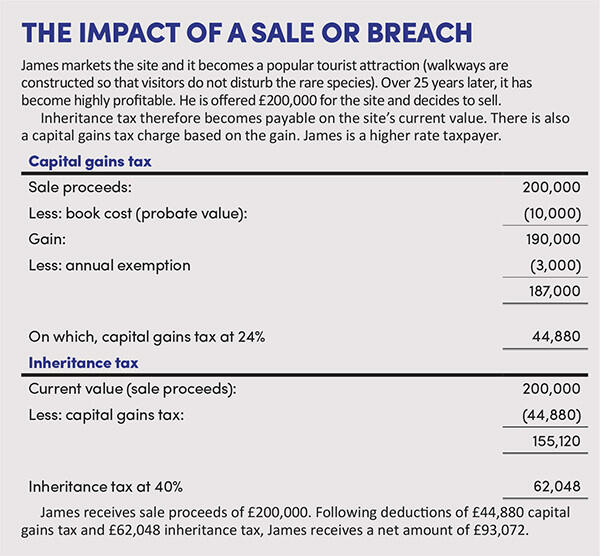

If an item is sold, or the undertakings are breached, inheritance tax becomes payable based on the current value of the item. Capital gains tax will also be payable if the asset is being disposed of at a gain as normal. Under the Taxation of Capital Gains Act (TCGA) 1992 s 258(8), any capital gains tax is deducted from the current value before calculating the inheritance tax charge. See The impact of a sale or breach.

If there have been multiple transfers that have been conditionally exempted, only one will become chargeable. HMRC may choose any transfer within the last 30 years before the breach: if there has been both a chargeable lifetime transfer and a transfer on death, it will obviously choose the latter in order to collect tax at 40%, rather than 20%.

If there have been no transfers within the last 30 years, HMRC will tax the most recent transfer.

If there have been no transfers within the last 30 years, and the most recent transfer was a transfer on death, the taxpayer might therefore choose to make a chargeable lifetime transfer (likely to a trust set up for that purpose) to create a transfer within the last 30 years on which inheritance tax would have been payable at 20%. On breach, HMRC will be obliged to charge inheritance tax at 20% rather than 40%.

Similarly, if the most recent conditionally exempt transfer was a transfer on death almost 30 years ago, it may be prudent to make a conditionally exempt chargeable lifetime transfer, and then wait until the death transfer falls off the 30 year clock before breaching. Note that to get the money out of the trust, there would be an inheritance tax exit charge.

Acceptance in lieu

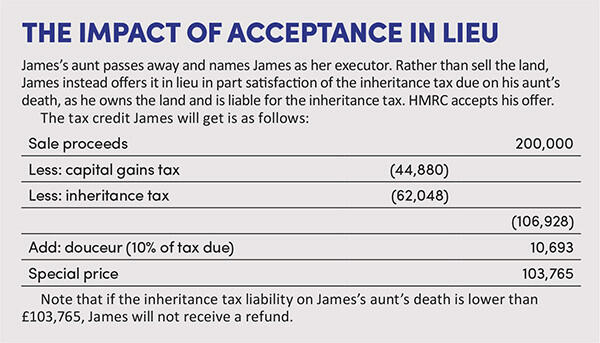

An individual may offer a heritage item in lieu of inheritance tax (or estate duty or capital transfer tax, if they have items previously conditionally exempted under these regimes and are now breaching the conditions).

The individual is offered a credit against tax payable on other items, based on:

- the net value they would have received for the heritage item if they had simply sold it and paid the tax; plus

- a ‘douceur’ which is calculated as 25% of the tax that would have been payable if the item is a chattel, or 10% of the tax due if the item is land.

The person offering the item in lieu must also be the person liable for the inheritance tax. Any acceptance in lieu credit in excess of the inheritance tax due is wasted.

See The impact of acceptance in lieu.

Private treaty sale to Schedule 3 body

If a conditionally exempt asset is sold to a body listed in Inheritance Tax Act 1984 Sch 3 (broadly these are various national galleries, and any government or local body), the conditional exemption charge does not ripen; nor is there any capital gains tax due as a result of TCGA 1992 s 258(2)(a).

HMRC guidance is that the price offered by the Schedule 3 body should broadly be in line with the special price calculated if the property was offered in lieu, although there is room for negotiation.

If the owner of a previously conditionally exempt asset is looking to sell, it may be more cost-effective for them to sell to a Schedule 3 body for a lower price than offered by another third party, as the tax relief may more than compensate for the difference. See Private treaty sale to Schedule 3 body.

Private treaty sale to Schedule 3 body: James is offered £105,000 by the Swindon Museum, which is an offshoot of Swindon Borough Council. Accordingly, it is treated as a Schedule 3 body. Although this is lower than the £200,000 offered above, after deducting the capital gains tax and inheritance tax due, James would only be left with £93,072 if he sold to the third party. Therefore, he is better off selling to the Swindon Museum for £105,000.

Heritage Maintenance Funds

Heritage Maintenance Funds are trusts used to maintain property that is eligible for conditional exemption. (Note that the property does not have to actually be conditionally exempted; it must merely qualify as such.)

Heritage Maintenance Funds are exempt from inheritance tax, unless capital is subsequently paid out other than for the maintenance of heritage property. There are therefore no relevant property charges (no inheritance tax entry charges, 10 year charges or exit charges if capital is used to maintain the property). Also, the assets are not in anyone’s estate for inheritance tax purposes.

There are various conditions that must be satisfied for a trust to qualify as a Heritage Maintenance Fund:

- Any assets added must be appropriate (i.e. income-producing) and not excessive for the purpose. There must be a minimum of £10,000 settled.

- Income must be used to maintain the heritage property or paid to an approved body.

- At least one trustee must be a professional trustee/trust corporation.

- The fund must be used to benefit the heritage property for at least six years.

If a Heritage Maintenance Fund is not settlor-interested (if the settlor is dead the trust cannot be settlor-interested), any income paid out is taxable as grant income in the hands of the recipient; i.e. the owner of the heritage property in question. There is therefore a double tax charge, as the Heritage Maintenance Fund will have paid tax already on its income.

The standard approach if a Heritage Maintenance Fund ends up being non-settlor interested is to terminate it and pay all the capital to the current owner of the heritage property, who then resettles it on a new Heritage Maintenance Fund within 30 days. This creates a new settlor-interested Heritage Maintenance Fund – and if this happens within 30 days, there is no inheritance tax charge. Any residual income in the Heritage Maintenance Fund is taxable – this can be paid out on repairs to the heritage property. Although this will be treated as grant income, it may be that there are enough expenses within the trading business to offset these.

Heritage Maintenance Funds have not proved terribly popular, but two common uses are:

- To test whether certain property will qualify for conditional exemption: HMRC will only approve the creation of the Heritage Maintenance Fund if it considers the property will qualify. There will be costs associated with creating a Heritage Maintenance Fund, so the taxpayer will need to weigh these up against the desire to know if something qualifies.

- To exempt certain outlying properties of a landed estate: For example, this could apply to farm cottages that might not themselves qualify for conditional exemption, although the main estate does. With the changes to agricultural property relief and business property relief, their use may therefore increase.

Cultural Gifts Scheme

This scheme is available to individuals and companies, but not personal representatives (i.e. deceased estates) or trustees. If an individual donates a pre‑eminent object or objects to the nation, they receive tax relief of 30% of the value of the object(s). This relief can be set against the individual’s income tax and capital gains tax liability for the year in which the donation is made, and/or any or all of the following four tax years. The amount of relief to be claimed for each year must be specified at the time of the donation and cannot be subsequently varied.

Relief will be deducted against the individual’s income tax liability first, followed by their capital gains tax liability. The relief will only reduce their tax liability to nil and cannot create a refund (although the taxpayer may be able to claim a refund with respect to tax paid at source).