Navigating the tax landscape: the challenges for 2024

Following a global BDO survey of senior tax professionals, we examine the challenges and opportunities we are all facing in 2024.

2024 is looking to be a challenging year for tax directors and all senior leaders who have responsibility for tax operations within the business. There is ongoing economic uncertainty, upcoming elections in the UK and US and the lingering effects of the Covid-19 pandemic. These factors, along with the need for tax authorities to maximise revenues and reduce costs – and for businesses to demonstrate greater transparency – create a complex landscape.

Initiative overload?

Tax leaders are facing a ‘risk multiplier’ effect due to a variety of intersecting risks arising from UK and global tax initiatives. The digitalisation of the economy has further complicated matters, with initiatives such as the G20/OECD BEPS Project and the Pillar Two Framework adding to the workload of tax directors.

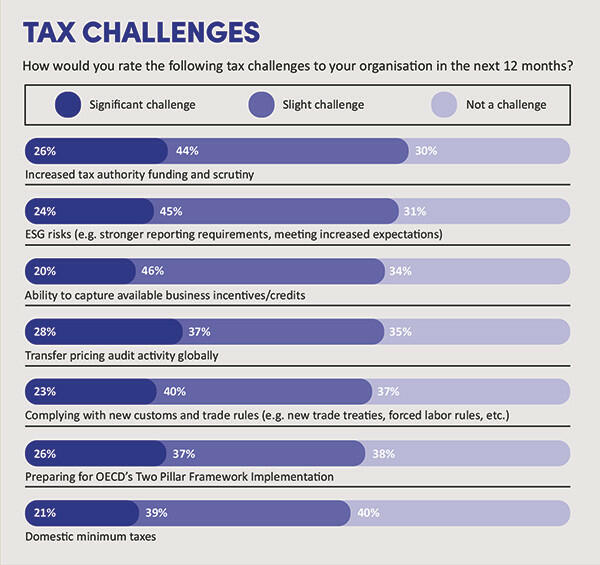

If you feel like this, you are not alone. In 2023, BDO carried out its Global Tax Outlook survey, seeking out the views of more than 630 senior decision makers, representing 48 countries (see tinyurl.com/kb24anm7). What we heard is that tax leaders keep raising the same five consistent challenges: risk, cost, efficiency, disputes and talent. Behind all of these, complexity in tax law is a major challenge, with increased scrutiny from stakeholders such as tax authorities, NGOs, media and civic society.

The most significant issue, with 70% of all respondents saying this is a key challenge, is ‘increased tax authority funding and scrutiny’ (see Tax challenges). This comes as no surprise, particularly for those in the UK. Below we share the experiences of a number of UK tax leaders when dealing with tax authorities, especially in relation to both the Business Risk Reviews (BRR+) and the introduction of the temporary Customer Compliance Manager (tCCM) model.

The tCCM initiative has been a notable recent development as HMRC seeks to provide a broader mechanism to more effectively engage with businesses. The scheme is aimed at a much wider base of businesses than those who already may be allocated a Customer Compliance Manager with the objective of providing ‘greater coverage’ by HMRC.

How businesses are responding

In order to better navigate these complex tax landscapes, businesses are striving to drive efficiencies, more effectively manage tax risk and demonstrate good governance to HMRC. Tax directors are seeking to establish a consistent approach to enhancing tax operations and developing a robust tax control framework.

From talking to hundreds of businesses we hear the same three objectives raised as key to achieving a robust tax control framework:

- A culture of no surprises over tax risk: This requires a clear vision for strong tax risk management, with a defined tax risk appetite, clear roles and responsibilities, a formalised risk identification methodology, a ‘living’ risk and control matrix, and defined reporting lines.

- Confidence in meeting evolving regulatory requirements: Tax directors want tax processes that are fit for purpose, compliant with legislation, nimble enough to respond to changes of law and able to withstand scrutiny from tax authorities and boards. Pillar Two is the most obvious example of this at the moment.

- A transparent and efficient tax control framework: This requires alignment of tax operations with the wider business’s governance (and ESG) agenda, adopting clear tax principles and demonstrating responsible tax behaviours. The tax control framework helps tax directors to enhance their current state and develop a roadmap to ensure effective global tax operations.

Working with stakeholders, especially tax authorities

On first sight, there is little silver lining to these challenges, especially the increase in the number of regulatory requirements facing businesses, both in the UK and internationally. Increased tax authority scrutiny is the number one challenge for tax leaders. In addition, other stakeholders – from the board to the investors – expect you to be fully tax compliant so that you are able to withstand tax authority reviews and avoid unexpected costs.

Building valuable relationships with tax authorities is crucial. These days, it’s not just about adhering to compliance and legal responsibilities. Increasingly, tax authorities want tax functions to demonstrate that they are operating effectively and can optimise tax delivery through the effective use of people, processes and technology. In other words, they want evidence of an effective tax control framework and, in the UK, the tax authorities have designed ways to work with businesses to prioritise this.

The temporary Customer Compliance Manager model

Most readers will be familiar with the Business Risk Review+ (BRR+) process, but for over a year now, HMRC has been piloting its tCCM model for mid-sized businesses. This initiative was designed to provide ‘time-limited one‑to-one’ support to mid-sized businesses, especially those that have significant growth, multiple enquiries or are simply new to requirements like the senior accounting officer regime and country-by-country reporting.

The scope of businesses eligible for a tCCM is much wider than many corporates may be accustomed to. Unlike ‘large’ businesses with a turnover of over £200 million and who may be allocated a Customer Compliance Manager, mid-sized businesses are defined as having a turnover of over £10 million and/or more than 20 employees. This expands the potential reach of the tCCM regime to a large number of businesses.

We have seen a number of letters from HMRC allocating a tCCM to our clients. In HMRC’s own words, the objective of this is to:

- ‘ensure effective two-way communication to enable prompt resolution of any issues;

- agree on the most efficient channels for exchanges of information; and

- develop a work plan early in our engagement to give you certainty around timeframes.’

Embracing the opportunities of tCCM and BRR+

We encourage businesses to embrace these HMRC initiatives or at least try to turn them into a positive experience. Many of our clients are seeing value in engaging with the tCCM, and discussing their tax operations and business transparently and cooperatively. For larger organisations, these meetings can evolve into BRR+ assessments.

The BRR+ process has been around for a number of years. See About the Business Risk Review process for further information.

In the words of many of our clients, both the BRR+ and/or the allocation of a tCCM offers the opportunity to take ownership of their relationship with HMRC and demonstrate low-risk behaviours, ideally leading to a low (or moderate) risk rating. The benefits of this are clear both in terms of a greater culture of no surprises and ensuring a level of assurance to share with the board and other stakeholders.

About the Business Risk Review Process

The BRR+ process (the next phase of the original BRR) was developed with the intention of enabling businesses to gain a clearer understanding of their risk rating. The BRR+ process typically involves an initial request for information from HMRC, as well as a face to face meeting with a presentation by the business on how it is managing its tax risk.

The main features of the BRR+ are:

- There are four risk categories: low, moderate, moderate-high and high.

- The business landscape (including size, complexity and degree of change) will be considered.

- There is a more detailed review across each type of tax, with an assessment of 24 low risk indicators, separated into three categories (systems and delivery, internal governance and approach to tax compliance).

- A business will have a higher risk rating the more low risk indicators it fails to meet.

Benefits of a low BRR+ risk rating

Achieving a low BRR+ risk rating sets the tone for your relationship with HMRC and potential benefits include:

- Low risk businesses should be subject to BRR+ reviews less frequently.

- Interactions with HMRC should, in general, be driven by the business rather than HMRC, so that enquiries instigated by HMRC will be the exception rather than the rule.

Feedback on TCCM AND BRR+

‘Prior to the BRR+, we had a rather reactive relationship with HMRC. Having the chance to talk about our business and tax issues as part of the BRR+, it now feels like we now have a more collaborative relationship. It’s in both parties’ interest to understand each other’s needs. In my experience, being open and receptive during the BRR+ exercise and having a dedicated person at HMRC allocated to us has been beneficial for both sides.’

Tax leader at a well-known utility company

‘Having our own Customer Compliance Manager at HMRC has proved invaluable to us over the years. Although we also have external professional advisers to assist us, having the ability to send an email or pick up the phone to a dedicated HMRC resource provides additional comfort, ensuring compliance in what can often be fairly complex areas of tax.’

Christina Wilson, Finance Director, John Sisk & Son Ltd

‘We were appointed a tCCM after our first senior accounting officer certification. The tCCM has been outstanding in helping resolve compliance issues from the past and helping us get current. Highly collaborative and helpful.’

Head of Tax at a leading veterinary care provider

Taking control

Businesses can – if they want – ask about being allocated a tCCM. There are various advantages and disadvantages to this and tax leaders may or may not see value in doing so. HMRC likes direct dialogue and there are clear benefits in proactively reaching out to tax authorities if there are concerns and issues that need to be shared, rather than waiting for HMRC to ‘lift the stones’ themselves.

The tCCM model is not going to go away. In late 2023, HMRC published its research carried out by Ipsos during the year (see tinyurl.com/yt97xet6). There were a number of key findings, including:

- Businesses generally had poor experiences of HMRC interaction before the tCCM model.

- Participation in the tCCM model helped businesses to manage their immediate tax issues and improved perceptions of HMRC.

- Some suggestions for improvement centred on some level of permanence for the tCCM model.

It is no surprise therefore that, given the findings of the survey, HMRC has confirmed that it will continue with the tCCM initiative as part of its overall compliance approach to mid-sized businesses.

Looking ahead

We have seen that the role of tax directors is becoming increasingly complex and challenging. The digitalisation of the economy and the introduction of G20/OECD initiatives are just two examples of where these challenges are being compounded. Our survey identified some common challenges faced by tax leaders, with increased funding and scrutiny from tax authorities being a significant concern. To address these, businesses must manage tax risk effectively, establish a consistent approach to enhancing their tax operations and develop a robust tax control framework.

The allocation of tCCMs by HMRC underscores the importance of building valuable relationships. UK businesses should be ready to engage constructively with tax authorities, including through the new tCCM initiative whether voluntarily or otherwise, and demonstrate transparency and cooperation. These increased demands on tax leaders aren’t going away so it’s far better to take the initiative when it comes to managing your tax risk in 2024.

The BDO Global Tax Outlook survey is available at: tinyurl.com/kb24anm7