Negotiating R&D relief: practical pointers

We consider the key challenges involved in R&D enquiries and set out some practical pointers about how to tackle them.

Key Points

What is the issue?

Many companies are facing tax enquiries on their historic R&D tax credit claims with HMRC demanding repayment of tax credits already paid out.

What does it mean for me?

Advisers may be asked to support their clients through such enquiries, even though they were not involved in compiling the original R&D claim, so must understand why HMRC is challenging claims and the process needed to resolve them.

What can I take away?

Contemporaneous evidence about the technical background to the R&D project and knowledge on the technical problem that was ‘readily available’ at the time of the project is often crucial. Knowledge of HMRC powers during an enquiry, including information requests, appeals and assessments, is also needed. Therefore, working with specialist advisers in R&D and tax disputes is often necessary for effective resolution with HMRC.

HMRC will commence an enquiry into research and development (R&D) claims under Finance Act 1998 Sch 18 para 24. It has adopted a ‘volume compliance approach’ with a clear focus on opening enquiries in bulk: HMRC’s latest published figures state that it is now checking over 20% of claims (i.e. one in five claims are now selected for enquiry). This article focuses on the key challenges that advisers face when dealing with an HMRC R&D enquiry and what to bear in mind.

Background to R&D

R&D tax relief measures are designed to incentivise and support companies to invest in innovative projects involving science and technology to support growth and innovation in the UK economy. Tax relief based on a company’s qualifying R&D expenditure is given by either reducing a company’s corporation tax liability or by making a cash payment to the company (i.e. an R&D tax credit).

Up until 1 April 2024, HMRC operated three schemes:

- the small and medium-sized enterprises (SME) scheme;

- the R&D intensive scheme (for loss making SMEs with a high R&D spend); and

- the R&D expenditure credit (RDEC) scheme.

The merged scheme starts for accounting periods beginning on or after 1 April 2024, replacing the SME and RDEC schemes (the R&D intensive scheme continues). Practically, we do see some companies claiming under the wrong scheme, which is a key point for advisers and claimants to get right.

Definition of R&D

To manage enquiries efficiently and seek resolution with HMRC, it is crucial to understand the meaning of R&D for UK taxation purposes (other countries may use alternative definitions and terminology). The Department for Science, Innovation and Technology defines R&D as follows:

‘R&D for tax purposes takes place when a project seeks to achieve an advance in science or technology … through the resolution of scientific or technological uncertainty’.

It goes on to state that ‘an advance in science or technology means an advance in overall knowledge or capability in a field of science or technology (not a company’s own state of knowledge or capability alone).’ Furthermore: ‘Scientific or technological uncertainty exists when knowledge of whether something is scientifically possible or technologically feasible, or how to achieve it in practice, is not readily available or deducible by a competent professional working in the field.’

R&D non-compliance

R&D tax reliefs are valuable to business, with the most recent figures published by HMRC showing that the total claims in 2022/23 were worth £10.2 billion. However, HMRC, the Treasury and the National Audit Office have all highlighted non-compliance as a significant problem within the R&D tax relief process in recent years.

Understanding what constitutes R&D and understanding the rules for making a valid claim on a company’s corporation tax return can be complex. Errors occur through genuine mistakes, such as in the computation of a claim, by a misunderstanding of the rules or by including certain costs for R&D projects that do not qualify. HMRC also considers that there is a significant element of fraudulent abuse within the regimes. Using its mandatory random enquiry programme, HMRC estimated that the level of error and fraud in R&D tax relief claims during 2022/23 was £1.1 billion (or 13.3% of related R&D expenditure).

Our experience shows that HMRC is using several measures to tackle non-compliance. This includes:

- checking claims before and after making a payment to the claimant companies;

- reviewing amended corporation tax returns to understand why the initial claim for relief was incorrect;

- opening enquiries into claims, to challenge the amount of relief claimed or whether the activities qualified for R&D at all;

- writing to companies suggesting that the submitted claims may be incorrect via its Fraud Investigation Service; and

- undertaking criminal investigations with a view to a prosecution.

Practical challenges and pointers

1. Stuck in ‘correspondence tennis’

HMRC’s volume compliance approach involves writing to claimant companies to enquire into the R&D claim. This includes requesting information and documents from the business to support the R&D activity undertaken and to ensure that the correct amount of qualifying costs were claimed.

Gathering the relevant information and articulating the nature of the R&D activity can be time consuming. Inevitably, HMRC may seek further clarification during the enquiry process. Before long, the challenge evolves into what is best described as ‘correspondence tennis’ – the to-ing and fro-ing of correspondence with HMRC.

In almost all cases, early engagement between HMRC and the relevant competent professional via a face-to-face meeting should be encouraged, as set out in HMRC’s Corporate Intangibles Research and Development Manual (at CIRD80525) and the Enquiry Manual (at EM1822).

Where this has not happened and where there appears to be a breakdown in communication, alternative dispute resolution may prove the key to unlock ‘stuck’ cases, particularly where the facts are misunderstood, where evidence is incomplete or where there is a breakdown in communication.

2. Issues with the ‘competent professional’

What happens if the competent professional has left or is concerned about meeting HMRC?

The role of the competent professional and their technical assessment of the underlying R&D activity is an essential aspect of the R&D regime. The R&D activity is usually highly technical and articulating the technological advances and the related uncertainties overcome – both in writing and in a method which is easy to understand – is a challenge.

This reinforces the benefits of discussions between HMRC and the competent professional. Although now mandatory for R&D claims submitted since 8 August 2023 (the Additional Information Form requires it), a detailed report drafted by the competent professional to clarify the R&D activity undertaken and the qualifying expenditure incurred is equally essential.

Early drafting of such forms and reports can help in instances where the relevant competent professional leaves their role or to minimise costs where the company uses an external expert. Providing HMRC with such evidence from the relevant competent professional (i.e. the necessary technical assessment) during the course of an enquiry is crucial as it can then be relied upon if the case ever goes to tribunal (see HMRC v Grazer Learning Ltd [2021] UKFTT 348 (TC)).

3. HMRC thinks the solution was readily available

It is important that sufficient information in support of the qualifying R&D activity is clarified to HMRC. This should include helping HMRC to understand the business, the R&D activity and the scientific or technical advancement.

It is worth noting that HMRC’s officers are not science or technology experts, nor can they be expected to be experts in every niche field. HRMC’s enquiry letter requests that technical explanations are set out ‘at a high level, in a form understandable to the non‑expert’.

It should also be noted that technological advances happen all the time and what is ‘readily available’ now may not have been readily available before. Therefore, understanding and documenting what is readily available (and importantly what is not readily available) during an R&D project is equally important, as is providing documentary evidence of what is readily available during the relevant year of the R&D claim.

4. Insufficient documentary evidence

It is possible that due to changes in IT systems, the sale of a business or as a result of personnel leaving the business, there may be gaps in evidence in support of a genuine R&D claim. Every effort should be made to maintain and retain sufficient documentary evidence.

Having sufficient evidence to support that an activity qualified for R&D purposes and met the appropriate criteria per the guidelines is of great importance (see HMRC v AHK Recruitment Ltd [2020] UKFTT 7718 (TC)).

5. Out of time to open an enquiry

HMRC has powers to issue discovery assessment for years that are too late to open enquiries, but can it really go back 20 years?

Where HMRC concludes that a claim for R&D tax relief was incorrect, it may consider that previous or subsequent R&D tax relief claims may also be incorrect. HMRC discovery powers allow it to raise assessments for accounting periods which are out of time to open an enquiry. HMRC must issue such assessments within statutory time limits following the end of the accounting period.

Consideration must be given to the nature of the behaviour that gave rise to the mistake made within the R&D claim by the company or someone acting on behalf of the company. Where it can be demonstrated that the company (or someone acting on its behalf) took reasonable care, the appropriate time limit is four years. Where the behaviour was careless, the relevant time limit is six years. However, where the behaviour is found to be deliberate, HMRC can go back 20 years.

6. Impact of rejected claims on group relief and losses

Where a company is part of a group that qualifies for group relief (Corporation Tax Act 2010 Part 5), it may surrender losses to other group members. Where a loss-making group member makes a claim for R&D tax relief, any losses can be used to reduce the taxable profits of companies in the same group. If an R&D claim is subsequently rejected by HMRC, this impacts the quantum of the loss of the loss-making company, which in turn affects the tax position of the other group members.

7. Penalties for errors

Is professional advice alone enough to demonstrate that reasonable care was taken?

Where it is identified that a company’s corporation tax return contained an error due to careless or deliberate behaviour, HMRC will consider imposing tax-geared penalties. The level of penalty will depend on the exact category of behaviour and whether the company came forward voluntarily (i.e. unprompted) or whether the error was identified as part of an enquiry (i.e. prompted).

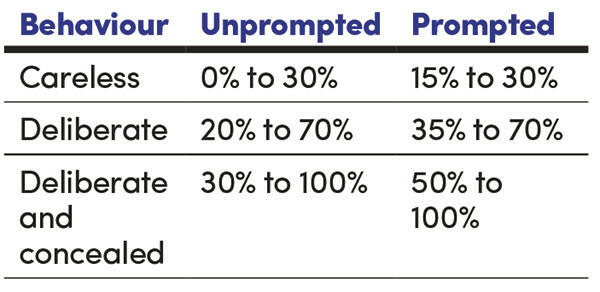

The relevant penalties per Finance Act 2007 Sch 24 para 1A are as follows:

The exact level of penalties depends on the ‘quality’ of the disclosure. Receiving expert advice during the enquiry or disclosure process can help to mitigate the level of penalties imposed.

HMRC’s Compliance Handbook (at CH81130) confirms that no penalty is due when a taxpayer was ‘acting on advice from a competent adviser which proves to be wrong despite the fact that the adviser was given a full set of accurate facts’. This implies that obtaining and relying on professional advice can help to demonstrate that a taxpayer has taken reasonable care which, in turn, removes the risk of HMRC imposing penalties.

However, the reality is that obtaining professional advice alone is not enough. Taxpayers, including companies making R&D tax relief claims, can be considered to have taken reasonable care if they:

- obtain appropriate professional advice from someone with relevant expertise in R&D;

- provide their adviser with a full set of accurate and relevant information;

- review the R&D advice received as best as they can;

- check the tax return prior to authorising submission;

- keep records of the above steps to evidence they took reasonable care; and

- if in doubt regarding any of the advice obtained, the company should consider a second opinion.

8. Finance Act 2008 Sch 36 information notice

HMRC usually requests information informally to check claims. Where it does not receive the details needed, it may issue a formal information notice (Finance Act 2008 Sch 36 para 1). The information requested must be ‘reasonably required’ for the purposes of checking the tax return and claims within it.

HMRC may impose penalties for the failure to comply with a formal information notice. Further penalties may be imposed for concealing, destroying or otherwise disposing of a document that is the subject of an information notice.

9. Confusion: is an appeal required?

Where HMRC rejects an R&D claim, there is often some confusion as to whether it has made a formal decision which can be appealed. Care should be taken to check whether HMRC ‘intends to issue a closure notice’ (which implies that the letter received does not contain an appealable decision) or whether the letter itself is the closure notice. In practice, we find these are not labelled as such, so it is often unclear.

Where HMRC has not issued a ‘formal decision’ or closure notice, any appeal will be rejected by HMRC’s appeals team. Conversely, failure to recognise a formal decision may mean that the statutory 30 day deadline to appeal is missed. Bringing the confusion to HMRC’s attention within the 30 days is often the best solution; as well as considering the merits of submitting an appeal to protect the company’s position.

10. Understanding subsidised and subcontracted costs for R&D tax relief purposes

These areas frequently lead to challenges by HMRC and there are currently several cases before the Tax Tribunal on them. While we expect more case law to clarify whether HMRC’s strict interpretations of the law are correct, it is worth noting that for claims made under the new merged scheme, some of these issues should fall away.

In conclusion

There is evidence of misuse and abuse of R&D tax relief which has led HMRC to take necessary action to protect Treasury monies. However, the practical challenges faced when dealing with a company tax enquiry can often be to the detriment of genuine R&D tax relief claimants.

This, in turn, can have an impact on a company’s willingness to invest further in innovation – undermining the government’s economic strategy. We also see companies needing to spend time, energy and resources to defend their claims in an enquiry which can be long running. HMRC accounts show the average time for company tax enquiries is 18 months in duration.

Regardless of the numerous challenges, the volume of R&D enquiries is likely to remain high for the foreseeable future. HMRC using targeted resources is now ‘business as usual’ in other areas of tax, such as wealthy individuals and transfer pricing for corporates.

On the plus side, taxpayers who obtain appropriate expert advice and adopt suitable enquiry defence strategies will be able to limit the disruption to their business and continue to benefit from tax reliefs.