Property capital gains tax: a comprehensive guide

We explore the UK capital gains tax implications of disposing of UK property by both UK and non-UK residents, including outlining the filing requirements and relevant deadlines.

Key Points

What is the issue?

Individuals (including UK resident trustees and personal representatives) who own UK property need to be familiar with the UK tax implications and filing requirements when they are disposing of UK property. This is often overlooked, which can result in HMRC levying penalties and interest on the late filing of the property capital gains tax return and payment of the capital gains tax liability.

What does it mean for me?

With ever-evolving tax legislation, it is essential that tax advisers are equipped to advise UK property owners when they are disposing of their UK properties. This means accurately calculating capital gains tax liabilities, utilising available reliefs and meeting reporting deadlines to avoid penalties and interest. This impacts both UK and non-UK resident individuals.

What can I take away?

The key takeaways for tax advisers include calculating the capital gains tax liability, understanding the exemptions and reliefs available, and practical tips.

For individuals (including UK resident trustees and personal representatives) who dispose of UK property, capital gains tax can be a significant cost, especially given the substantial increase in many property values over time.

Capital gains tax is the tax levied on the capital gain (profit) realised from the disposal of an asset. In most instances, UK capital gains tax arises when an individual disposes of a property that has increased in value since acquisition. The disposal could be by way of gift, transfer or sale to a third party. On disposal, the capital gain will then be subject to capital gains tax.

For example, if a UK resident purchased a UK residential property for £200,000 and later sold the property for £500,000, capital gains tax would be payable on the £300,000 profit, minus any allowable expenses. The capital gains tax annual exemption may be available to offset against the capital gain arising (£3,000 for the 2024/25 tax year). The individual may also be eligible for capital gains tax reliefs such as private residence or lettings relief.

In the context of UK residential property disposals, understanding the capital gains tax implications for both UK and non-UK residents is essential as the method for calculating the capital gain or loss arising is different.

UK residential property disposals: UK residents

Calculating the capital gains tax liability for UK residents involves a few steps. The first step is to determine the sale price of the property. This will be the proceeds received if the sale is to an unconnected party, or the market value of the property at the date of completion if the transfer, sale or gift is to a connected party. Where the sale is to a connected party, a professional valuation is recommended (and HMRC may seek its own valuation).

From the proceeds value (or deemed proceeds value), you should deduct the allowable costs, which include the original purchase price, enhancement expenditure (such as capital improvements) and incidental costs of acquisition and disposal (such as legal fees, surveyor fees, stamp duty land tax and estate agent fees). The resulting figure represents the capital gain or loss. Please note that in order for the expenditure to be allowable, the costs must be directly related to the disposal or transfer of the property and the value of any enhancements must be reflected in the property when sold.

After calculating the capital gain, you should consider if any capital gains tax reliefs are available. We have provided a brief outline of the main reliefs available within this article below.

The capital gains tax annual exemption may also be available to offset against the capital gain. Once the capital gain has been calculated, capital gains tax will be calculated using the residential property capital gains tax rates which are 18% for basic rate taxpayers and 24% for higher or additional rate taxpayers for the 2024/25 tax year. The residential property capital gains tax rates are higher than the standard capital gains tax rates of 10% for basic rate taxpayers and 20% for higher or additional rate taxpayers. If you are normally a basic rate taxpayer but when you add the gain to your taxable income you are pushed into the higher rate band, then you will pay some capital gains tax at both rates.

Chancellor Rachel Reeves has announced that the Autumn Budget will be on 30 October 2024. There is speculation that increases to the capital gains tax rates will be announced in the Budget. It is important to consider the impact of any potential changes.

UK residential property disposals: non-UK residents

Calculating the capital gains tax liability for non-UK residents who dispose of UK residential properties is similar to the process above, but with a few key differences. Non-UK residents have three different options available to calculate their UK capital gains tax liability. Choosing the most beneficial method for your client can help to optimise their UK tax position.

- Rebasing to 5 April 2015 value: This method involves calculating the gain or loss based on the market value of the property as at 5 April 2015. In essence, the purchase price is uplifted, therefore usually resulting in a lower capital gain.

- Time apportionment method: This method involves calculating the total capital gain or loss over the entire period of ownership, and then apportioning to calculate the capital gain or loss since 5 April 2015. This method is useful if the property has been owned for a long period of time and the gain since April 2015 represents a small proportion of the total gain.

- Gain over the whole period of ownership: This method involves calculating the capital gain or loss based on the original purchase price of the property. This method may be suitable if your client has made a capital loss.

Non-UK residents are subject to the same capital gains tax rates on UK residential property (18% for a basic rate taxpayer and 24% for a higher or additional rate taxpayer).

Care should be taken if the non-UK resident is also required to report and pay overseas tax in another jurisdiction on the disposal of UK residential property. Typically, the primary taxing right is allocated to the jurisdiction where the property is situated, although seeking overseas tax advice is always recommended.

We have not provided information in this article regarding calculating the capital gain or loss for non-UK resident clients on the disposal of non-residential property or land and indirect disposals such as property held through a company or trust. Please be mindful that the rules for calculating the capital gain or loss may differ from the above methods.

Capital gains tax exemptions and reliefs

Private residence relief

Private residence relief can significantly reduce or even eliminate the UK capital gains tax liability if the property was the individual’s main or only residence for all or part of the ownership period. To qualify for private residence relief, an individual must have lived in the property and used it as their main residence.

Where an individual has lived in the property and used it as their main residence for the duration of ownership, any capital gain on the disposal will be exempt from capital gains tax. However, where occupation and ownership periods are not the same, it is imperative that the ownership period for private residence relief purposes is worked out correctly.

Under the current rules, the actual occupancy period and the last nine months of ownership of the property (regardless of whether the individual is living in the property) always qualify for private residence relief.

Private residence relief may also be available during periods of physical absence from the property, and these periods are known as ‘deemed occupation’. A period of absence can only be treated as a period of deemed occupation if it was both preceded and followed by a period of actual physical occupation. The three period of absences that will qualify as deemed occupation are as follows:

- any period up to a maximum of three years for any reason;

- any period working overseas, due to reason of their employment; and

- a period up to a maximum of four years if absent from the property due to working elsewhere in the UK (as an employee or self-employed trader).

If your client owns more than one residential property (which includes a tenancy), they are able to make a private residence relief election within two years of having more than two residences. If a private residence relief election is not made, the main residence will be a question of fact and HMRC will look at the quality of occupation rather than time spent at the property. It is also important to note here that the property is required to be suitable to be occupied as a main residence. It is important to consider an election where one property is subject to deemed occupation.

If there is a delay in taking up residence due to carrying out construction work, tax legislation allows the relief so long as that period of absence does not exceed 24 months in total.

Lettings relief

Please note that private residence relief is not available if a proportion of your client’s property is let out. The proportion of the capital gain arising in relation to the let element will therefore be chargeable to capital gains tax. However, where private residence relief is restricted due to this, lettings relief may be available.

Lettings relief is available if your client occupied the property as their main residence whilst letting out part of their property as residential accommodation. The relief is not available for any period during which your client’s whole property was let out. The amount of the relief available is the lowest of:

- the amount of private residence relief the individual received;

- £40,000; and

- the amount of chargeable gain arising by reason of the letting.

Please note that lettings relief cannot turn a capital gain into a loss; it can only reduce a capital gain to nil.

Annual exempt amount

Every individual has an annual exempt amount (£3,000 for the 2024/25 UK tax year), which can be deducted from the gain, reducing the amount chargeable to capital gains tax.

Practical example:

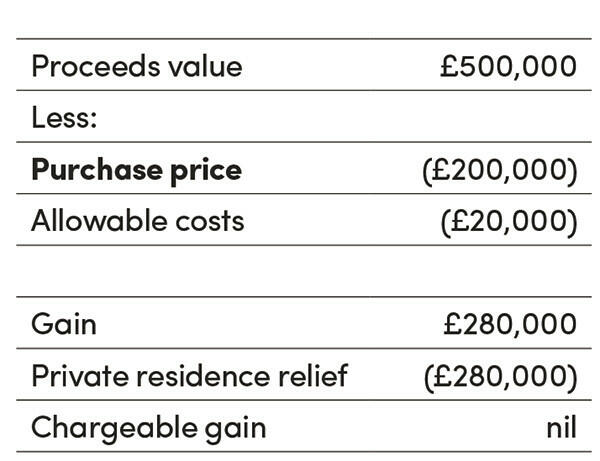

Consider a scenario where a UK resident individual purchased a UK residential property for £200,000 in 2010 and sold the property for £500,000 in July 2024, incurring £20,000 in allowable costs (legal fees and enhancement expenditure). The individual has lived in this property for the total ownership period and used the property as their main residence.

The calculation for disposal of the property would be as follows:

However, a non-UK resident individual who had disposed of the above property would need to consider the three different computational options listed above in order to calculate their most tax efficient UK capital gains position.

Although unlikely given the non-UK residence status, the UK residential property may qualify for private residence relief. If that is the case, the three computational options listed above would not considered. There are, however, certain rules in order for non-UK residents to claim private residence relief which are not covered in this article.

Practical tips and filing requirements

The 60 day reporting deadline

Capital gains tax on UK residential property must be reported via the UK property capital gains tax return and the capital gains tax must be paid to HMRC within 60 days of completion. If this deadline is not met, penalties and interest charges may apply. We would recommend that all advisors ensure that their clients have all the necessary documentation in advance to ensure prompt submission by the deadline.

For a UK resident, the above reporting and payment requirements do not affect those selling a property if there is no capital gains tax payable on the disposal. This may be due to meeting the criteria for private residence relief or if the property was sold at a loss, for example.

For non-UK residents, the above reporting and payment requirements are relevant even if there is no capital gains tax payable on the disposal of the property.

Your clients will also most likely be required to report the disposal of their UK residential properties on their UK self-assessment tax returns. However, if your client is required to file a capital gains tax return to report a UK residential property disposal within 60 days of completion, they will not be required to file a UK tax return if they have no other reason to do so.

Accurate record keeping

Accurate record-keeping is essential. This includes keeping detailed records of all property transactions, improvements and associated costs to ensure accurate calculations and compliance. Clients should also be recommended to keep receipts, invoices and other documentation in an organised and accessible manner where possible. This not only aids in accurate capital gains tax calculations but also ensures claims can be substantiated if queried by HMRC.

Understanding capital gains tax reliefs

Misunderstanding or overlooking available capital gains tax reliefs can lead to overpayment or underpayment. For example, knowing the exact periods when private residence relief applies or the conditions for lettings relief may make a significant difference in the tax liability.

Inheritance tax considerations

Ensuring your clients are aware of the capital gains tax and inheritance tax implications of transferring property to family members as a gift is important. Such transfers can be treated as potentially exempt transfers for inheritance tax purposes, which may become taxable if the donor passes away within seven years of the transfer. Ensuring your clients understand these rules can help them plan effectively and minimise tax liabilities.

Conclusion

This comprehensive overview of residential property capital gains tax aims to provide practical guidance and tips, making it easier for both resident and non-UK resident clients to manage their property tax obligations effectively. Whether your client is a seasoned property owner or new to the market, a clear understanding of property capital gains tax can help them navigate the complexities and make informed decisions.