The payrolling of benefits: new employer obligations

As the government refines its plans to make the payrolling of benefits compulsory from April 2026, we take a look at the current rules and challenges to mandating.

Key Points

What is the issue?

The government announced in January 2024 its intention to make the payrolling of benefits compulsory from April 2026, thus doing away with P11Ds. This new mandatory employer obligation may not be as straightforward as employers think.

What does it mean to me?

All payrolled benefits need to be included on the Full Payment Submission, which is sent to HMRC on or before each pay day. It is likely that more fields will need to be included ahead of mandatory payrolling, or employers will need to make sure they have kept a separate record of each benefit to enable an audit trail and employee statements to be produced.

What can I take away?

Start to think as early as possible about the benefit and expenses data flow and how you can achieve this in real time to ensure the payroll is correct, particularly if data is held in multiple systems.

A lot has changed since P11D forms were introduced in the early 1960s. In April 2016, the voluntary payrolling of benefits in kind was introduced. Adding the value of a benefit to the employee’s salary so that the PAYE system automatically charges the right amount of tax should improve the taxpayer experience. Employers have so far been allowed the flexibility to decide whether they want to payroll a benefit and which benefits to include, as opposed to completing forms P11D (Income Tax (Pay As You Earn) Regulations 2003 Reg 85(4)).

In a potentially significant development, the government announced in January 2024 its intention to make the payrolling of benefits compulsory from April 2026, thus doing away with P11Ds. This new mandatory employer obligation may not be as straightforward as employers think.

We understand that HMRC officials are scheduling further meetings with external stakeholders ahead of the summer parliamentary recess to discuss revisions to the current voluntary process with draft legislation to be published later this year. This is good news, and it will be interesting to see what is planned and what effect the payrolling of benefits in kind has on the tax-geared penalties regime, as well as HMRC compliance activity.

But what are the current rules and therefore some of the challenges to mandating?

Can all benefits be payrolled?

Currently, in accordance with Income Tax (Pay As You Earn) Regulations 2003 Reg 61A, any employer provided benefit can be payrolled, except for:

- interest free and low interest loans; and

- living accommodation provided by the employer.

However, for the first time HMRC has set the official rate of interest at the start of the tax year, being 2.25% for 2024/25. This means that the legislation can be changed to allow these benefits to be payrolled relatively straightforwardly.

How do employers currently payroll benefits in kind?

Before employers can start, they must register with HMRC using the online service. Registration must be completed before the start of the tax year. Ideally, HMRC prefers registration to occur before the annual coding process begins, typically around 21 December. This helps to prevent the employer from receiving multiple tax codes for their employees.

While employers have the discretion to choose which benefits to payroll, there is a specific category of benefits that requires an all-or-nothing approach. These are the benefits that would be reported as ‘other’ items in Section M on the P11D. These include professional subscriptions. Consequently, employers must either payroll all items usually reported within Section M, or none.

An exception to this rule is the ‘Income tax paid but not deducted from a director’s remuneration,’ which is typically reported under Section M. This benefit must be selected and payrolled as a standalone benefit when using the online service.

Upon registering, HMRC will automatically identify all employees with the selected benefits or expenses in their tax code and remove them, issuing an amended tax code in its place. Employers only need to register to payroll each benefit for all their employees once. Unless the benefit is removed, payrolling will be carried forward each tax year. Once the tax year has started, employers must continue to payroll the registered benefit for the entire tax year, or for as long as it is provided. HMRC has now enabled agent access to the payrolling of benefits and expenses online service, allowing agents to register or remove benefits to be payrolled, on behalf of their clients.

The tax due on payrolled benefits is collected by adding a notional value to an employee’s taxable pay each pay period in the payroll. To calculate the cash equivalent of the benefit to payroll, the employer needs to work out the benefit value (in the same way as would have been done when preparing P11Ds) and the number of payments to be made to the employee in the tax year. The cash equivalent of the benefit is divided by the total number of pay periods.

The resulting amount is added to the employee’s pay in the payroll each pay period. The item will usually be taxable and not subject to NIC for payroll purposes as Class 1A NIC applies, but this will depend on the treatment of the individual benefit (Income Tax (Pay As You Earn) Regulations 2003 Regs 61D–61LA).

It’s important to note that only payrolled benefits should be reported on the Full Payment Submission. Any non-cash benefits not payrolled are reported under the existing P11D procedure.

If an employer decides to payroll car and car fuel benefits, information detailed on the P46(Car) must be reported on the Full Payment Submission.

How do you report via Real Time Information?

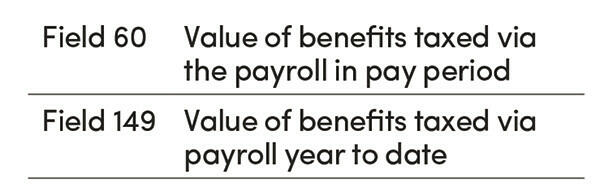

All payrolled benefits need to be included on the Full Payment Submission, which is sent to HMRC on or before each pay day. The current fields available on the Full Payment Submission are:

It is likely that more fields will need to be included ahead of mandatory payrolling, or employers will need to make sure they have kept a separate record of each benefit in another system or process to enable an audit trail and employee statements to be produced.

What about the 50% limit on tax deductions?

The 50% regulatory limit, also known as the ‘overriding limit’ in the legislation, stipulates that an employee cannot have a tax deduction greater than 50% of their taxable pay in that pay period. This applies to PAYE income. With the introduction of the payrolling benefits regime, a rule was established that the value of payrolled benefits is specifically excluded from the calculation of taxable pay. Therefore, the 50% limit applies to the total pay, less the value of payrolled benefits.

This could result in a tax deduction that is greater than the taxable pay in a period where the pay is low and there is also tax due on payrolled benefits, such as when an employee is on temporarily reduced or no pay while sick, on maternity or on parental leave.

In this situation, the employer has two options:

- Exclude the employee from benefits payrolling: Employers should use the payrolling benefits and expenses online service to exclude the employee from the system. When the employee is excluded, the value of the benefit will be reported on their P11D and the tax collected usually via their tax code. To recommence payrolling in the new tax year, the employee is removed from the exclusion list.

- Keep the employee within the benefit payrolling regime: Payroll systems will apply the 50% regulatory limit rules as normal, and any underpayment of tax will be recovered in the following pay period(s).

HMRC assumes that most employers will prefer the second option. If there are not enough pay periods to recover the uncollected tax, HMRC will calculate any underpaid tax following receipt of the final Full Payment Submission, and will notify the employee accordingly. We assume therefore that this option is the approach HMRC will likely choose to make compulsory when mandating is in place from April 2026.

What happens when an employee leaves?

Typically, benefits cease on an employee’s final day of employment. However, there may be instances where the employee is permitted to use, or is entitled to, the benefit beyond the termination of their employment contract. If a benefit continues to be provided after departure, it is usually added to other relevant cash termination payments to ascertain the value of the termination payment and its tax and NIC treatment.

In other cases, taxable benefits should be included within the employer’s payrolled benefits reports. The employer needs to recalculate the value of the benefit up to its end date and make any necessary adjustments to the payrolled value, ideally before the employee leaves. This process may pose challenges and invoke the application of the 50% regulatory limit in cases where the employee provides little or no notice of departure.

Currently, if the entire taxable value of the benefit has not been accounted for before the last payroll run (or can’t be as part of it), the employer has two options:

- Add the balance of the cash equivalent to taxable pay to date as a taxable amount in the Full Payment Submission, informing HMRC that the employee has left. As there is no actual cash payment, the tax paid to date figure remains the same.

- Include the balance of the cash equivalent on a P11D for the individual, covering the value only for the period of availability for which the benefit was not included in payroll.

We expect this process to change going forward if HMRC will no longer accept P11Ds in any circumstances from April 2026.

What if any employee makes good in full or part a benefit (other than cars and van fuel)?

Some employees may make a payment towards the cost of a benefit, known as ‘making good’, such as net pay benefits. When this occurs, it reduces the cash equivalent of the benefit under the tax rules. If the full cost is made good, there is no taxable benefit. Employers need a process for checking making good has occurred.

If an employee is only making good in part, this needs to be considered when calculating the amount to be payrolled.

If the employer is unable to deduct the full amount of tax due from the final payment (e.g. month 12 for monthly paid employees), then the process is the same as those described under ‘the 50% limit’ above.

What about making good for company cars and van private fuel?

An employer may have an agreement with an employee that they will make good the actual cost of private fuel to avoid a fuel benefit. Employers need to consider how to deal with this during the tax year. Employees must make good the cost of their car/van fuel used for private mileage before 1 June of the following tax year, to avoid a benefit in kind charge.

If the employee fails to make good in full before the 1 June following the end of the tax year, the full fuel benefit charge needs to be added to the next payroll run after 1 June. The payment is not split out across the year. This is because the fuel benefit charge is an ‘all or nothing’ charge.

How should employers communicate payrolled benefits to employees?

Once employers have registered for the payrolling of benefits, it is crucial to notify their employees that benefits will now be taxed through the payroll.

Employees should receive a letter explaining the concept of payrolling of benefits, its operation and its implications, including the deduction of tax through payroll and changes to their tax code. This also applies to new employees who receive benefits that the employer has registered to payroll. Before 1 June following the end of the tax year, employees should also receive details of:

- the benefits that have been payrolled in the tax year; and

- the cash equivalent of each benefit that has been payrolled in the tax year.

If an employee completes a self-assessment tax return, they will need these details to report the total amount of PAYE income and the benefits they received on the Employment Page of the return, along with their pay. However, because the taxable value of the benefit has been included in the total taxable pay figure on the P60 or P45, the payrolled benefit values must not be reported separately on the self-assessment form, otherwise, the employee will end up paying tax twice on those benefits.

Employees should also be reminded that non-payrolled benefits – i.e. those detailed on the P11D – still need to be reported on their self-assessment returns.

Will employees be taxed twice?

The only instance of quasi ‘double’ taxation that should occur is when the employee is compensating for an underpayment from the previous year, which would have occurred regardless. This often happens to benefits reported on P11D during the second year, as the first P11D is not submitted until 6 July after the year the benefit was enjoyed. Over the duration of the benefit, however, the appropriate amount of tax should be deducted, whether through payrolling or traditional forms.

What about employers Class 1A NIC?

Although the tax due on the benefits is being collected in ‘real time’ under voluntary payrolling, no provision has currently been made for the collection of Class 1A NIC on a real-time basis. The employer still currently needs to complete the P11D(b) and calculate Class 1A NIC – again this may change in future.

This means that employers need to keep a record of the final year-to-date value of payrolled benefits and which class of NIC they are subject to. Benefits may only be subject to either Class 1 NIC or Class 1A NIC, and the employer must ensure they don’t pay both.

What about globally mobile employees?

A range of considerations will arise for employers who have a globally mobile workforce. This will include UK based employees working on overseas assignments (or where remote working overseas) and where overseas employees are working on assignment to the UK.

For employees working on assignment in the UK, the new rules will further underline the practical issues and challenges around obtaining benefit details on a real-time basis where benefits are provided outside the UK. HMRC recognises these challenges and makes some accommodations. For example, it allows for PAYE to be calculated on a best estimate basis for tax equalised employees (i.e. when an employer settles any UK tax and National Insurance (NIC) due for an employee) where a Modified PAYE scheme is in place (where NIC is payable, an Appendix 7A scheme will also be required). Under the scheme, a reconciliation of any tax due is performed upon the filing of an employee’s UK tax return with an extended P11D submission date of 31 January. Where NIC is due, this is reconciled with HMRC by 31 March. However, the focus around the processes and practicalities of obtaining overseas benefit details on a monthly basis will be reinforced.

For UK employees working outside of the UK, similar challenges will arise around collating benefits details where these are provided outside of the UK on a real time basis, and in particular, where an employee remains tax resident in the UK.

What should employers do now, ahead of April 2026?

- Start to think as early as possible about the benefit and expenses data flow and how they achieve this in real time to ensure the payroll is correct, particularly if data is held in multiple systems.

- Consider whether they will need any software to help them calculate the benefit in kind amounts and track the breakdown for reporting.

- Monitor developments on any revised legislation and guidance.

Consider whether they should start payrolling from April 2025 for some benefits ahead of mandating in April 2026, if they don’t already payroll any.

For globally mobile employees, look to implement processes and procedures which identify benefits provided to employees outside of the UK on a regular and real-time basis.