Tribunal penalties: suspension of disbelief

In the June issue of Tax Adviser, I reported on the Cooke case (‘Two DP or not two DP, that’s the problem’), where an in...

Carvajal v HMRC: attempts to mitigate inheritance tax

Without wishing to comment on the accuracy of the general public’s perception of inheritance tax, it is probably fair to...

PGMOL v HMRC: the long-awaited decision on employment status

Exactly three years ago, in the November 2021 issue of Tax Adviser, I wrote about the Court of Appeal’s decision in the ...

The pursuit of costs: litigation processes

A fundamental aspect of the tribunals system is that a tribunal is meant to be a more accessible forum for achieving jus...

HMRC v RALC Consulting: the latest review of IR35

The so-called ‘IR35 rules’ (more strictly, the ‘intermediaries’ legislation’) were announced just over 25 years ago with...

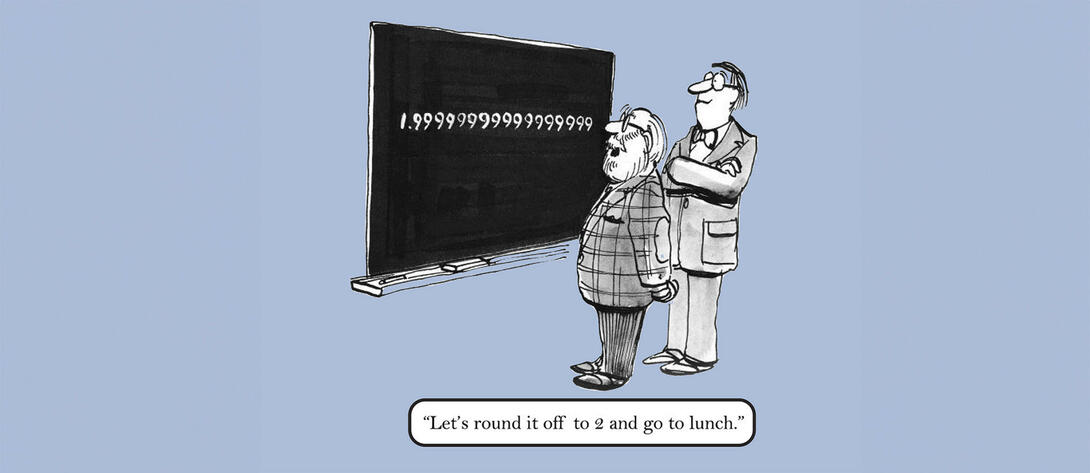

The case of Cooke v HMRC: the problems caused by a rounding error

Entrepreneurs’ relief (now business asset disposal relief) was introduced in the Finance Act 2008 and has survived longe...

Termination of employment: when is a payment tax free?

One of the issues that has regularly featured in the case law concerning employment tax is the taxation of payments rece...

Cash-based businesses: a claim that profits were overstated

Having just passed the 20th anniversary of the first of my monthly case reports and seeing that the official publication...

Taxing discretionary gifts to employees: OOCL UK Branch v HMRC

A payment made by an employer to an employee will usually be subject to tax as employment income and, in the case of a c...

Transfer of assets abroad: the boundaries of the rules

The transfer of assets abroad legislation (variously abbreviated to ToAA and TAA) was first enacted in 1936....